Question: please show how you go about getting this answer 11.Firm U and Firm L are identical and have the same cash flows. Firm U has

please show how you go about getting this answer

please show how you go about getting this answer

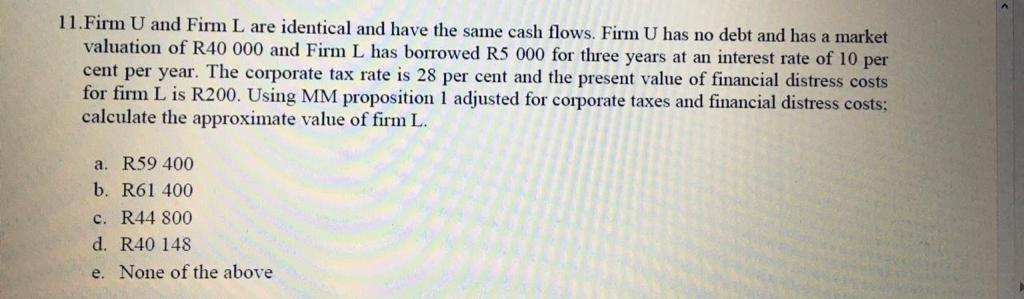

11.Firm U and Firm L are identical and have the same cash flows. Firm U has no debt and has a market valuation of R40 000 and Firm L has borrowed R5 000 for three years at an interest rate of 10 per cent per year. The corporate tax rate is 28 per cent and the present value of financial distress costs for firm L is R200. Using MM proposition 1 adjusted for corporate taxes and financial distress costs; calculate the approximate value of firm L. a. R59 400 b. R61 400 c. R44 800 d. R40 148 e. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts