Question: Please show how you got the answer for each question and the formula you used. Use the following data for questions 1 to 4. You

Please show how you got the answer for each question and the formula you used.

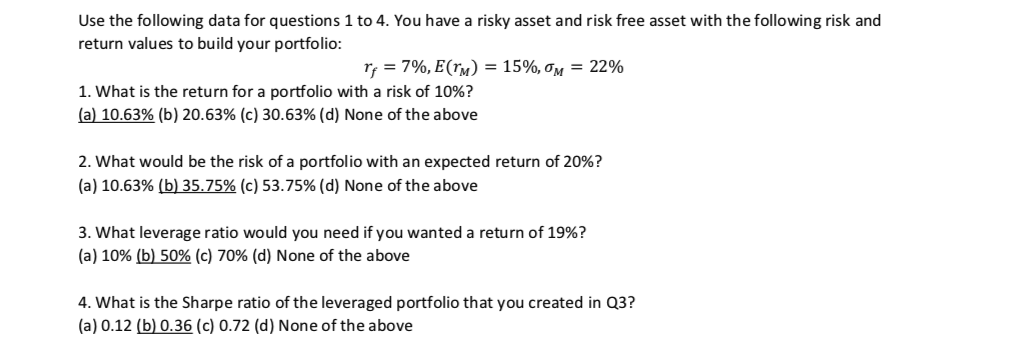

Use the following data for questions 1 to 4. You have a risky asset and risk free asset with the following risk and return values to build your portfolio: r = 7%, E(TM) = 15%, Om = 22% 1. What is the return for a portfolio with a risk of 10%? (a) 10.63% (b) 20.63% (C) 30.63% (d) None of the above 2. What would be the risk of a portfolio with an expected return of 20%? (a) 10.63% (b) 35.75% (c) 53.75% (d) None of the above 3. What leverage ratio would you need if you wanted a return of 19%? (a) 10% (b) 50% (c) 70% (d) None of the above 4. What is the Sharpe ratio of the leveraged portfolio that you created in Q3? (a) 0.12 (b) 0.36 (c) 0.72 (d) None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts