Question: please show how you got the answers! 5 Problem I Basic Costing Part A (19 points) Mason uses a job order cost system. During 2020

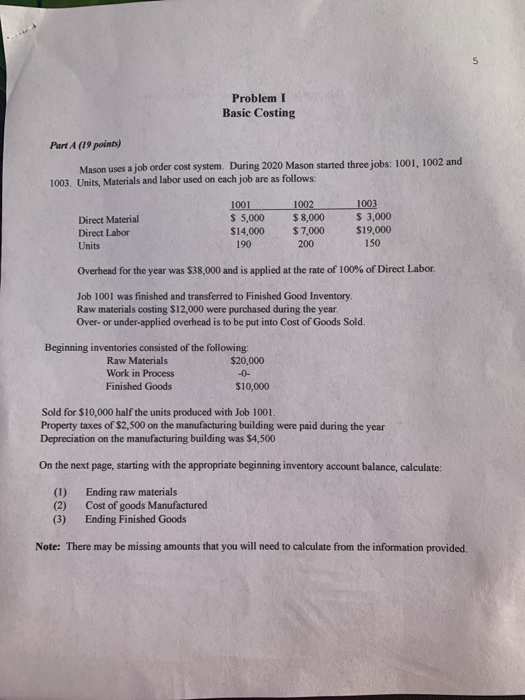

5 Problem I Basic Costing Part A (19 points) Mason uses a job order cost system. During 2020 Mason started three jobs: 1001, 1002 and 1003 Units, Materials and labor used on each job are as follows: Direct Material Direct Labor Units 1001 $ 5,000 $14,000 190 1002 $8,000 $7,000 200 1003 $ 3,000 $19.000 150 Overhead for the year was $38,000 and is applied at the rate of 100% of Direct Labor. Job 1001 was finished and transferred to Finished Good Inventory Raw materials costing $12,000 were purchased during the year Over- or under-applied overhead is to be put into Cost of Goods Sold. Beginning inventories consisted of the following: Raw Materials $20,000 Work in Process -0- Finished Goods $10,000 Sold for $10,000 half the units produced with Job 1001. Property taxes of $2,500 on the manufacturing building were paid during the year Depreciation on the manufacturing building was $4,500 On the next page, starting with the appropriate beginning inventory account balance, calculate: (1) Ending raw materials (2) Cost of goods Manufactured (3) Ending Finished Goods Note: There may be missing amounts that you will need to calculate from the information provided

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts