Question: Please show how you solved! Problem 2 Suppose the prices of zero-coupon bonds paying $100 at maturity are: Bond Price Time to maturity (years) B0,0.5

Please show how you solved!

Please show how you solved!

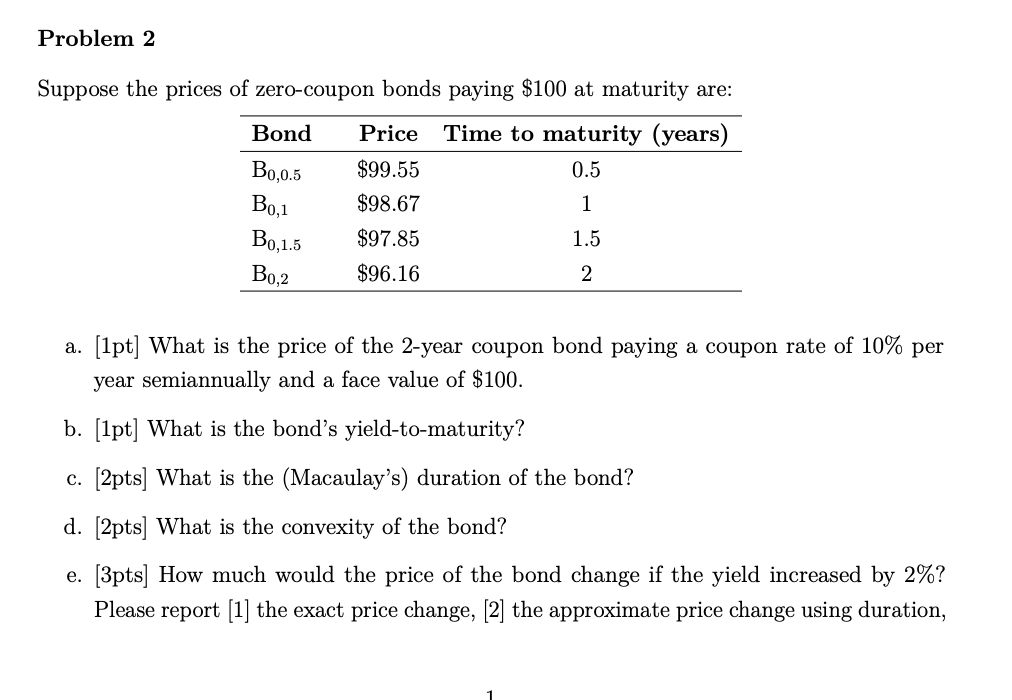

Problem 2 Suppose the prices of zero-coupon bonds paying $100 at maturity are: Bond Price Time to maturity (years) B0,0.5 $99.55 B0,1 $98.67 1 $97.85 1.5 $96.16 2 0.5 B0,1.5 B0,2 a. (1pt] What is the price of the 2-year coupon bond paying a coupon rate of 10% per year semiannually and a face value of $100. b. [1pt] What is the bond's yield-to-maturity? c. [2pts) What is the (Macaulay's) duration of the bond? d. [2pts) What is the convexity of the bond? e. [3pts) How much would the price of the bond change if the yield increased by 2%? Please report [1] the exact price change, [2] the approximate price change using duration, Problem 2 Suppose the prices of zero-coupon bonds paying $100 at maturity are: Bond Price Time to maturity (years) B0,0.5 $99.55 B0,1 $98.67 1 $97.85 1.5 $96.16 2 0.5 B0,1.5 B0,2 a. (1pt] What is the price of the 2-year coupon bond paying a coupon rate of 10% per year semiannually and a face value of $100. b. [1pt] What is the bond's yield-to-maturity? c. [2pts) What is the (Macaulay's) duration of the bond? d. [2pts) What is the convexity of the bond? e. [3pts) How much would the price of the bond change if the yield increased by 2%? Please report [1] the exact price change, [2] the approximate price change using duration

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts