Question: Please show how you worked it out Question 6 A business has two investment choices. Expected cash flows for each alternative are as follows: Project

Please show how you worked it out

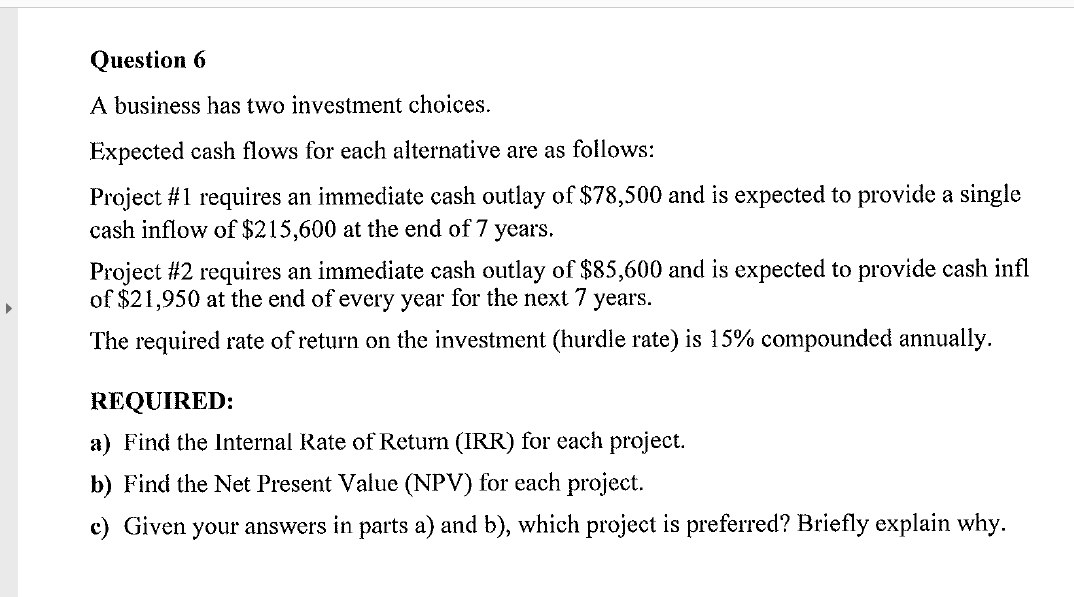

Question 6 A business has two investment choices. Expected cash flows for each alternative are as follows: Project #1 requires an immediate cash outlay of $78,500 and is expected to provide a single cash inflow of $215,600 at the end of 7 years. Project #2 requires an immediate cash outlay of $85,600 and is expected to provide cash infl of $21,950 at the end of every year for the next 7 years. The required rate of return on the investment (hurdle rate) is 15% compounded annually. REQUIRED: a) Find the Internal Rate of Return (IRR) for each project. b) Find the Net Present Value (NPV) for each project. c) Given your answers in parts a) and b), which project is preferred? Briefly explain why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts