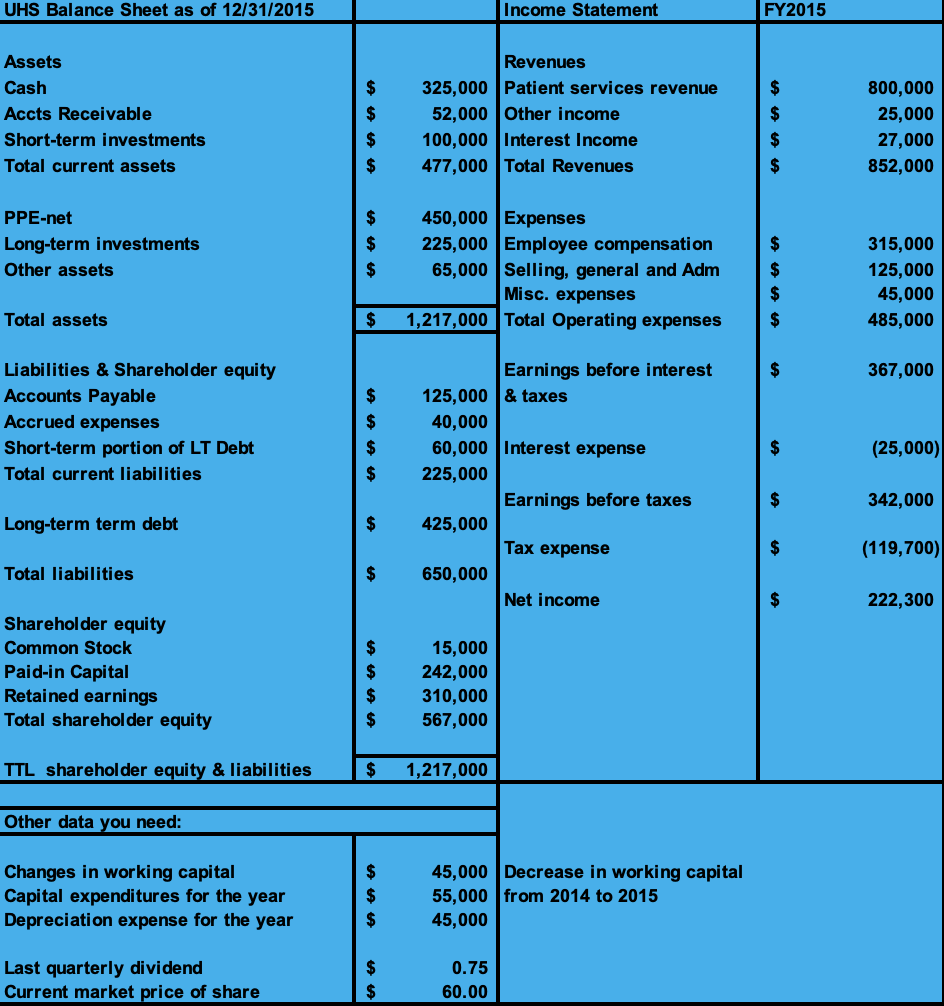

Question: Please show how you would solve for B, C, D, E AND F! UHS Balance Sheet as of 12/31/2015 Assets Cash Accts Receivable Short-term investments

Please show how you would solve for B, C, D, E AND F!

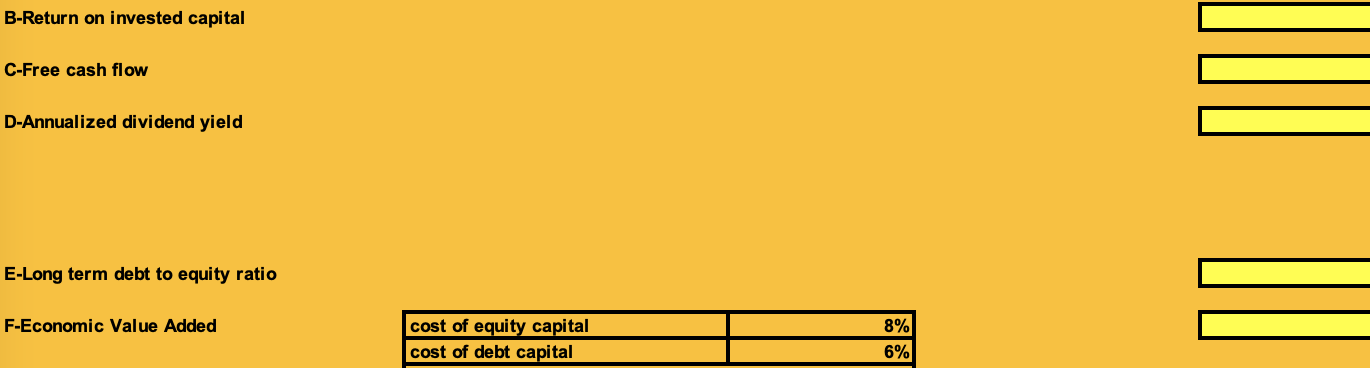

UHS Balance Sheet as of 12/31/2015 Assets Cash Accts Receivable Short-term investments Total current assets PPE-net Long-term investments Other assets Total assets Liabilities & Shareholder equity Accounts Payable Accrued expenses Short-term portion of LT Debt Total current liabilities Long-term term debt Total liabilities Shareholder equity Common Stock Paid-in Capital Retained earnings Total shareholder equity TTL shareholder equity & liabilities Other data you need: Changes in working capital Capital expenditures for the year Depreciation expense for the year Last quarterly dividend Current market price of share $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ Income Statement Revenues 325,000 Patient services revenue 52,000 Other income 100,000 Interest Income 477,000 Total Revenues 450,000 Expenses 225,000 Employee compensation 65,000 Selling, general and Adm Misc. expenses 1,217,000 Total Operating expenses Earnings before interest 125,000 & taxes 40,000 60,000 Interest expense 225,000 425,000 650,000 15,000 242,000 310,000 567,000 1,217,000 45,000 Decrease in working capital 55,000 from 2014 to 2015 45,000 0.75 60.00 Earnings before taxes Tax expense Net income FY2015 $ $ $ $ $ $ $ $ $ $ $ $ 800,000 25,000 27,000 852,000 315,000 125,000 45,000 485,000 367,000 (25,000) 342,000 (119,700) 222,300 B-Return on invested capital C-Free cash flow D-Annualized dividend yield E-Long term debt to equity ratio F-Economic Value Added cost of equity capital cost of debt capital 8% 6% UHS Balance Sheet as of 12/31/2015 Assets Cash Accts Receivable Short-term investments Total current assets PPE-net Long-term investments Other assets Total assets Liabilities & Shareholder equity Accounts Payable Accrued expenses Short-term portion of LT Debt Total current liabilities Long-term term debt Total liabilities Shareholder equity Common Stock Paid-in Capital Retained earnings Total shareholder equity TTL shareholder equity & liabilities Other data you need: Changes in working capital Capital expenditures for the year Depreciation expense for the year Last quarterly dividend Current market price of share $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ Income Statement Revenues 325,000 Patient services revenue 52,000 Other income 100,000 Interest Income 477,000 Total Revenues 450,000 Expenses 225,000 Employee compensation 65,000 Selling, general and Adm Misc. expenses 1,217,000 Total Operating expenses Earnings before interest 125,000 & taxes 40,000 60,000 Interest expense 225,000 425,000 650,000 15,000 242,000 310,000 567,000 1,217,000 45,000 Decrease in working capital 55,000 from 2014 to 2015 45,000 0.75 60.00 Earnings before taxes Tax expense Net income FY2015 $ $ $ $ $ $ $ $ $ $ $ $ 800,000 25,000 27,000 852,000 315,000 125,000 45,000 485,000 367,000 (25,000) 342,000 (119,700) 222,300 B-Return on invested capital C-Free cash flow D-Annualized dividend yield E-Long term debt to equity ratio F-Economic Value Added cost of equity capital cost of debt capital 8% 6%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts