Question: Please show important workings. On 1 January 2012 Circle plc acquired 80% of the issued shares of Square Ltd for a consideration of 240,000, and

Please show important workings.

Please show important workings.

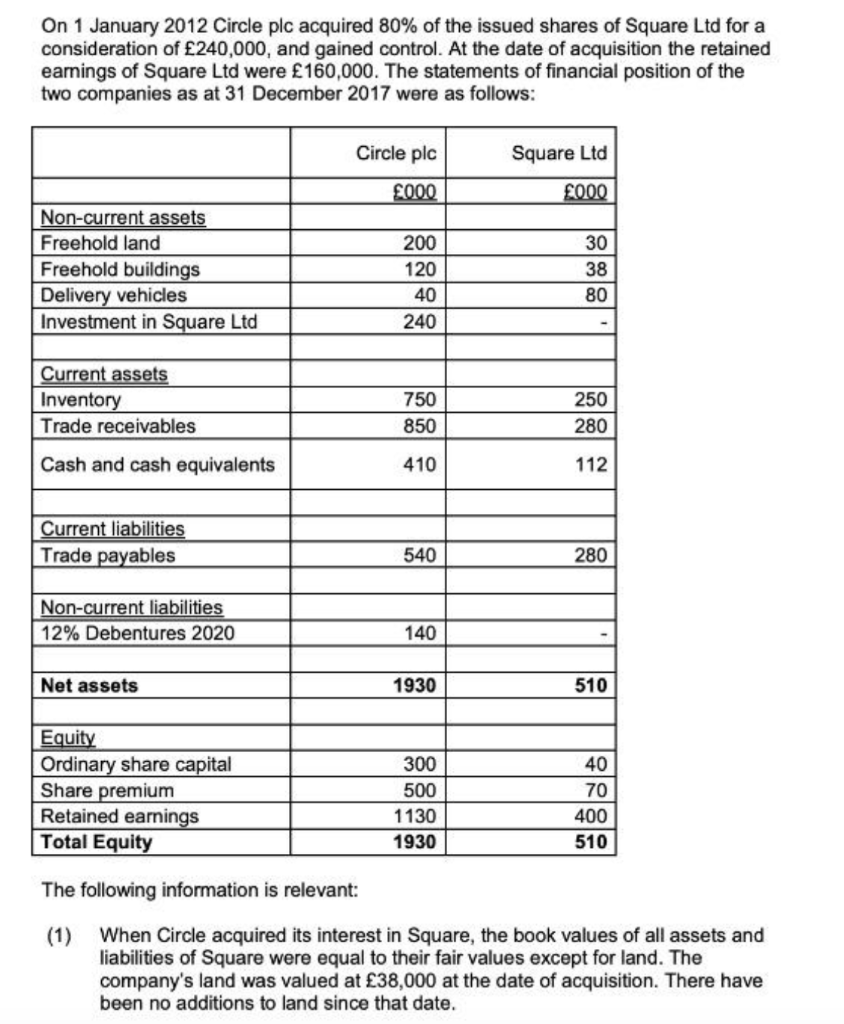

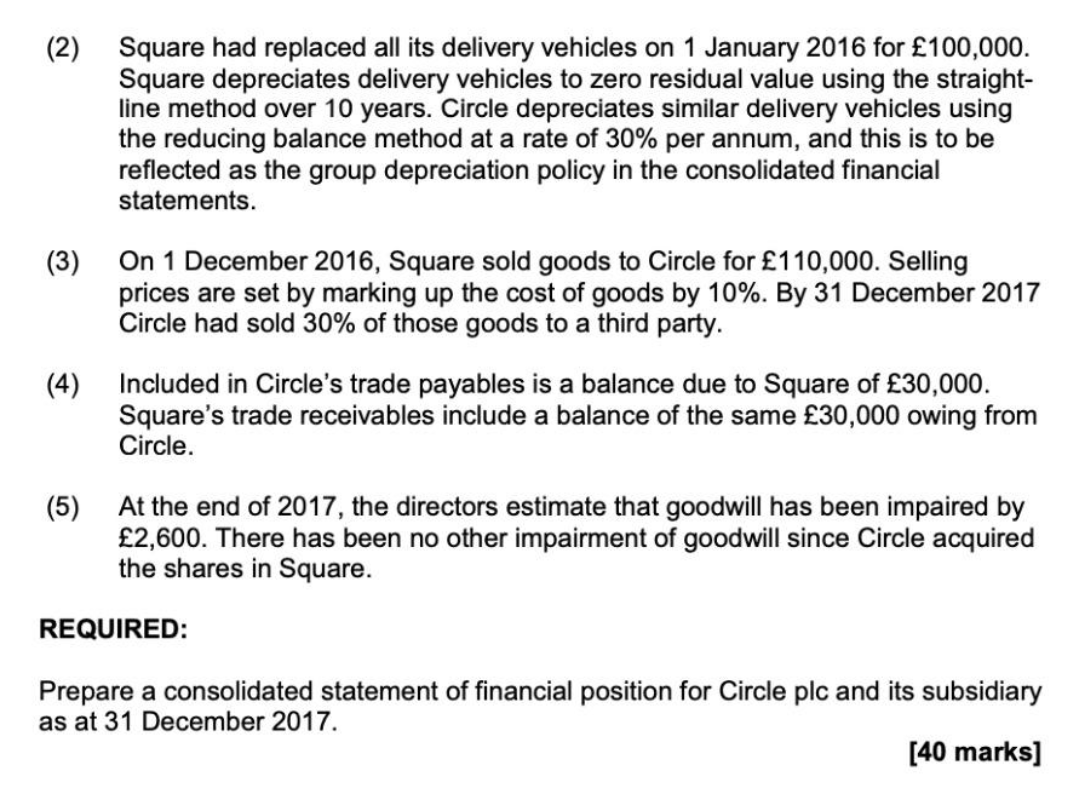

On 1 January 2012 Circle plc acquired 80% of the issued shares of Square Ltd for a consideration of 240,000, and gained control. At the date of acquisition the retained earnings of Square Ltd were 160,000. The statements of financial position of the two companies as at 31 December 2017 were as follows: Circle plc 000 Square Ltd 0 00 30 Non-current assets Freehold land Freehold buildings Delivery vehicles Investment in Square Ltd 38 200 120 40 | 240 80 Current assets Inventory Trade receivables Cash and cash equivalents 750 850 250 280 410 410 112 Current liabilities Trade payables 540 280 Non-current liabilities 12% Debentures 2020 140 - Net assets 1930 510 40 Equity Ordinary share capital Share premium Retained earnings Total Equity 70 300 500 1130 1930 400 510 The following information is relevant: (1) When Circle acquired its interest in Square, the book values of all assets and liabilities of Square were equal to their fair values except for land. The company's land was valued at 38,000 at the date of acquisition. There have been no additions to land since that date. (2) Square had replaced all its delivery vehicles on 1 January 2016 for 100,000. Square depreciates delivery vehicles to zero residual value using the straight- line method over 10 years. Circle depreciates similar delivery vehicles using the reducing balance method at a rate of 30% per annum, and this is to be reflected as the group depreciation policy in the consolidated financial statements. (3) On 1 December 2016, Square sold goods to Circle for 110,000. Selling prices are set by marking up the cost of goods by 10%. By 31 December 2017 Circle had sold 30% of those goods to a third party. (4) Included in Circle's trade payables is a balance due to Square of 30,000. Square's trade receivables include a balance of the same 30,000 owing from Circle. (5) At the end of 2017, the directors estimate that goodwill has been impaired by 2,600. There has been no other impairment of goodwill since Circle acquired the shares in Square. REQUIRED: Prepare a consolidated statement of financial position for Circle plc and its subsidiary as at 31 December 2017. [40 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts