Question: Please show in EXCEL: relevant to your task (all the market data are current).The firm's tax rate is 20%. The market data on XYZ Co's

Please show in EXCEL:

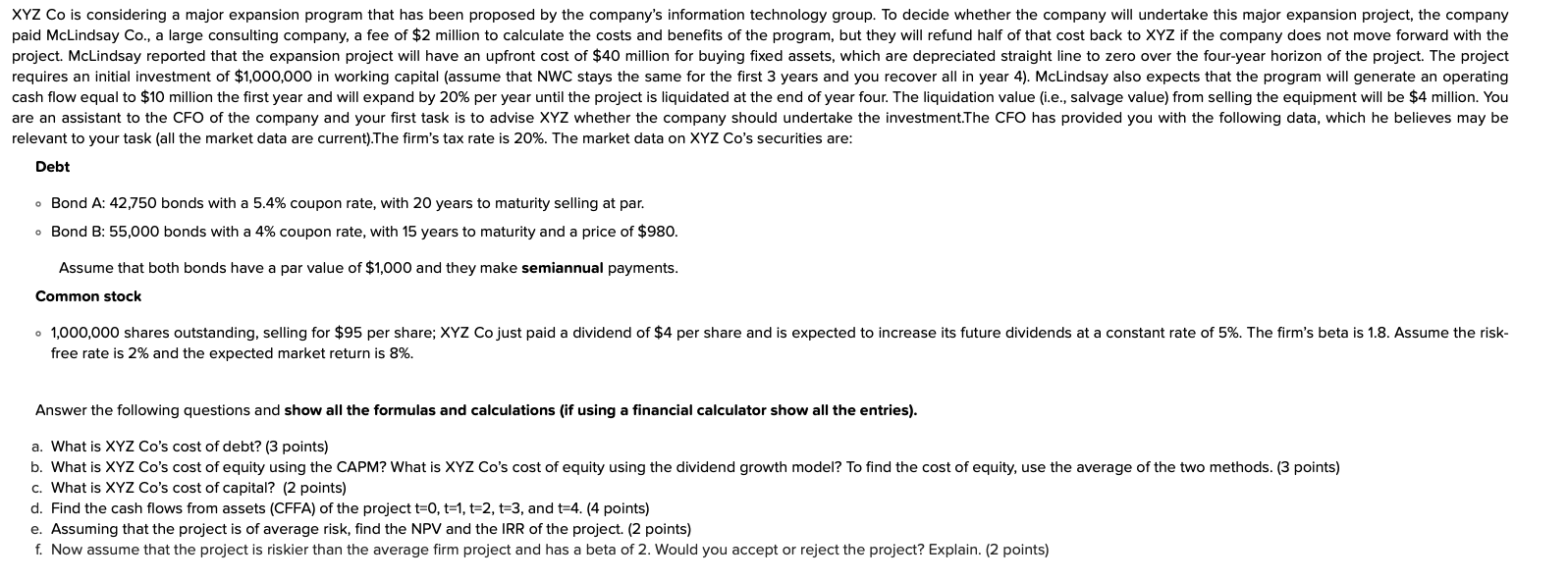

relevant to your task (all the market data are current).The firm's tax rate is 20%. The market data on XYZ Co's securities are: Debt - Bond A: 42,750 bonds with a 5.4% coupon rate, with 20 years to maturity selling at par. - Bond B: 55,000 bonds with a 4% coupon rate, with 15 years to maturity and a price of $980. Assume that both bonds have a par value of $1,000 and they make semiannual payments. Common stock free rate is 2% and the expected market return is 8%. Answer the following questions and show all the formulas and calculations (if using a financial calculator show all the entries). a. What is XYZ Co's cost of debt? ( 3 points) c. What is XYZ Co's cost of capital? (2 points) d. Find the cash flows from assets (CFFA) of the project t=0,t=1,t=2,t=3, and t=4. ( 4 points) e. Assuming that the project is of average risk, find the NPV and the IRR of the project. (2 points) f. Now assume that the project is riskier than the average firm project and has a beta of 2 . Would you accept or reject the project? Explain. (2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts