Question: PLEASE SHOW IN EXCEL SHEET AND PLEASE DO NOT COPY FROM DIFFERENT CHEGG ANSWERS Sportscraft Company is a manufacturer of specialty sports vehicles, which it

PLEASE SHOW IN EXCEL SHEET

AND PLEASE DO NOT COPY FROM DIFFERENT CHEGG ANSWERS

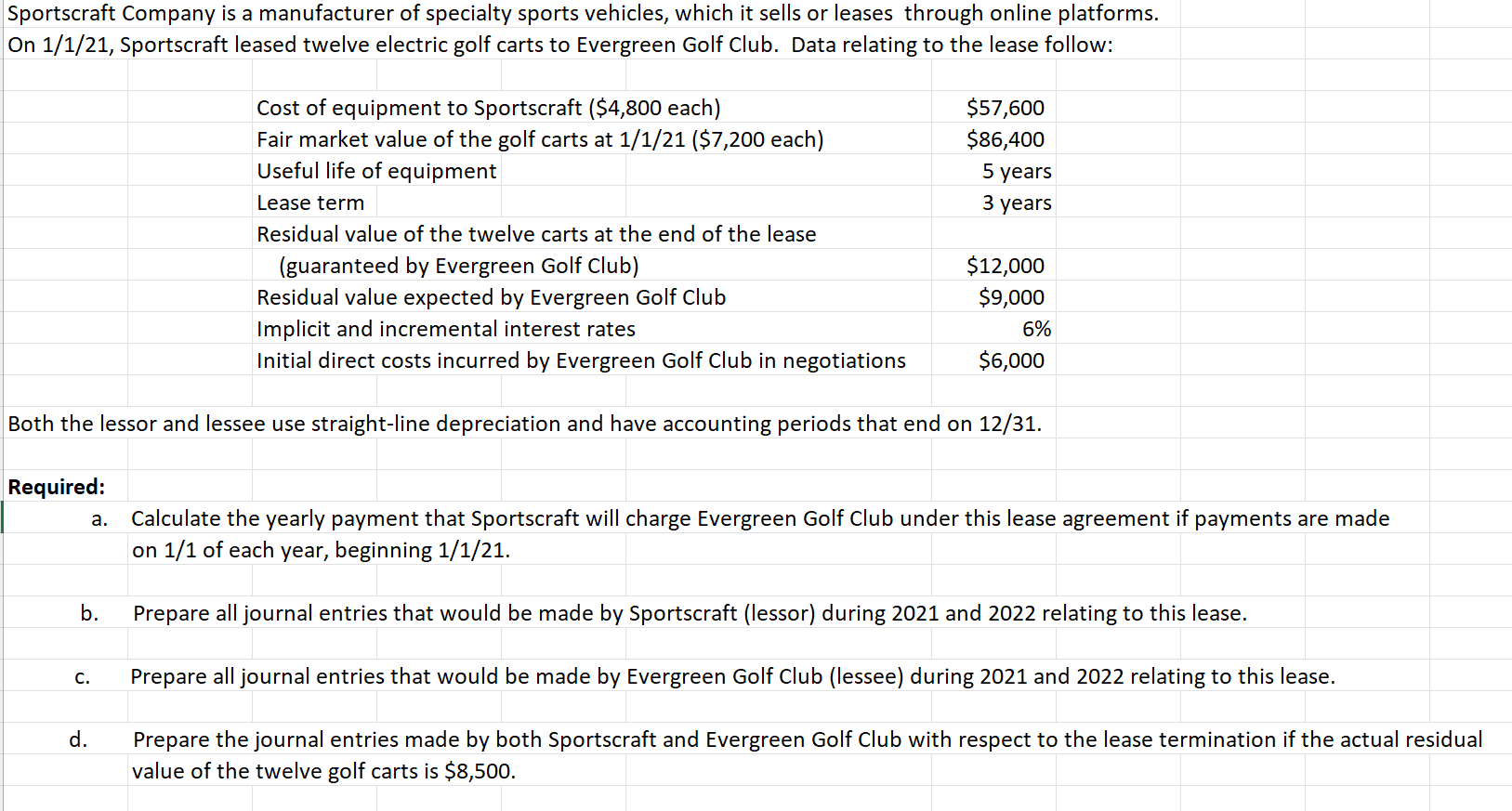

Sportscraft Company is a manufacturer of specialty sports vehicles, which it sells or leases through online platforms. On 1/1/21, Sportscraft leased twelve electric golf carts to Evergreen Golf Club. Data relating to the lease follow: $57,600 $86,400 5 years 3 years Cost of equipment to Sportscraft ($4,800 each) Fair market value of the golf carts at 1/1/21 ($7,200 each) Useful life of equipment Lease term Residual value of the twelve carts at the end of the lease (guaranteed by Evergreen Golf Club) Residual value expected by Evergreen Golf Club Implicit and incremental interest rates Initial direct costs incurred by Evergreen Golf Club in negotiations $12,000 $9,000 6% $6,000 Both the lessor and lessee use straight-line depreciation and have accounting periods that end on 12/31. Required: a. Calculate the yearly payment that Sportscraft will charge Evergreen Golf Club under this lease agreement if payments are made on 1/1 of each year, beginning 1/1/21. b. Prepare all journal entries that would be made by Sportscraft (lessor) during 2021 and 2022 relating to this lease. c. Prepare all journal entries that would be made by Evergreen Golf Club (lessee) during 2021 and 2022 relating to this lease. d. Prepare the journal entries made by both Sportscraft and Evergreen Golf Club with respect to the lease termination if the actual residual value of the twelve golf carts is $8,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts