Question: please show me how the correct answer comes from. show me the calculation steps, please Question 1 0 / 12.5 pts An investor has a

please show me how the correct answer comes from.

show me the calculation steps, please

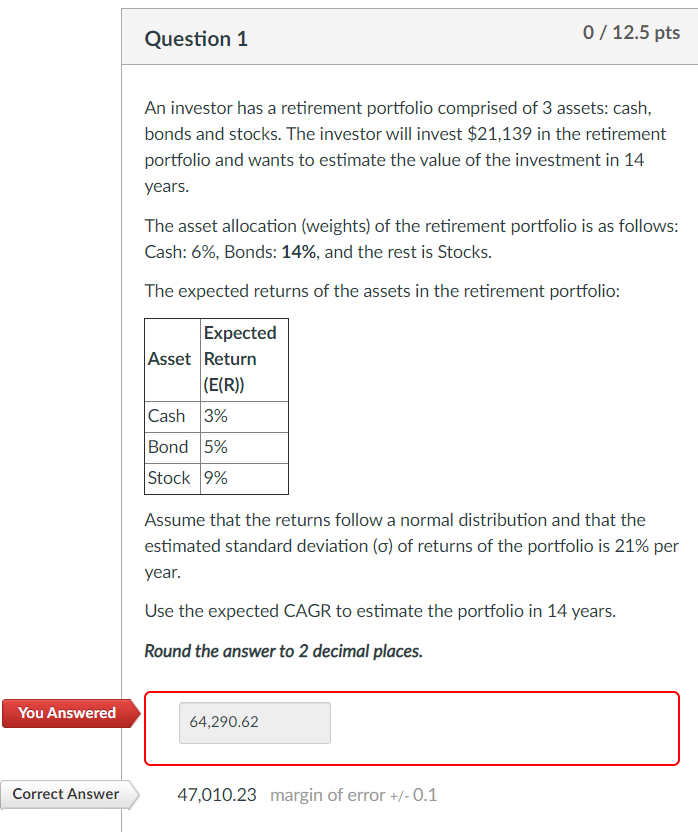

Question 1 0 / 12.5 pts An investor has a retirement portfolio comprised of 3 assets: cash, bonds and stocks. The investor will invest $21,139 in the retirement portfolio and wants to estimate the value of the investment in 14 years. The asset allocation (weights) of the retirement portfolio is as follows: Cash: 6%, Bonds: 14%, and the rest is Stocks. The expected returns of the assets in the retirement portfolio: Expected Asset Return (E(R) Cash 3% Bond 5% Stock 9% Assume that the returns follow a normal distribution and that the estimated standard deviation (o) of returns of the portfolio is 21% per year. Use the expected CAGR to estimate the portfolio in 14 years. Round the answer to 2 decimal places. You Answered 64,290.62 Correct Answer 47,010.23 margin of error +/- 0.1 Question 1 0 / 12.5 pts An investor has a retirement portfolio comprised of 3 assets: cash, bonds and stocks. The investor will invest $21,139 in the retirement portfolio and wants to estimate the value of the investment in 14 years. The asset allocation (weights) of the retirement portfolio is as follows: Cash: 6%, Bonds: 14%, and the rest is Stocks. The expected returns of the assets in the retirement portfolio: Expected Asset Return (E(R) Cash 3% Bond 5% Stock 9% Assume that the returns follow a normal distribution and that the estimated standard deviation (o) of returns of the portfolio is 21% per year. Use the expected CAGR to estimate the portfolio in 14 years. Round the answer to 2 decimal places. You Answered 64,290.62 Correct Answer 47,010.23 margin of error +/- 0.1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts