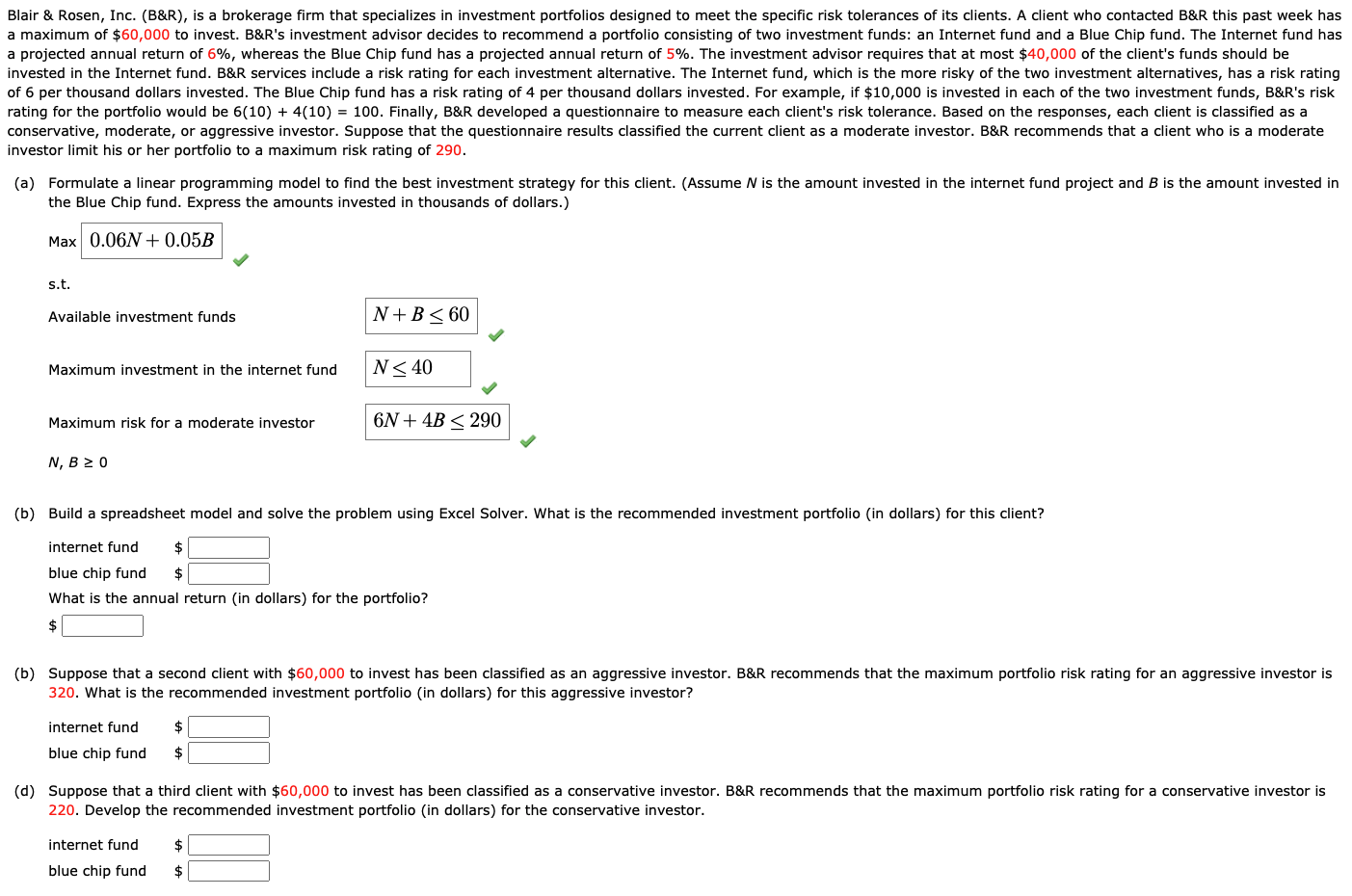

Question: Please show me how to do this step by step in Excel. please Blair & Rosen, Inc. (B&R), is a brokerage firm that specializes in

Please show me how to do this step by step in Excel. please

Please show me how to do this step by step in Excel. please

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock