Question: please show me how to do this with proper formatting. Thank You Bank Reconciliation Use the following information to prepare a bank reconciliation for Dylan

please show me how to do this with proper formatting. Thank You

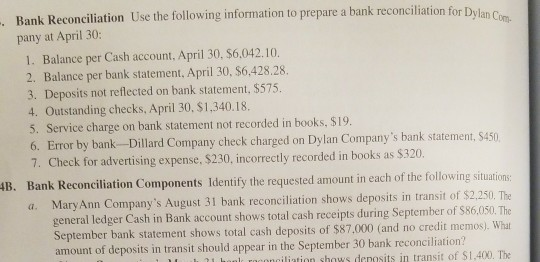

Bank Reconciliation Use the following information to prepare a bank reconciliation for Dylan Com- pany at April 30: 1. Balance per Cash account, April 30, $6,042.10. 2. Balance per bank statement, April 30, $6,428.28 3. Deposits not reflected on bank statement, $575 4. Outstanding checks, April 30, $1,340.18. 5. Service charge on bank statement not recorded in books, $19 6. Error by bank-Dillard Company check charged on Dylan Company's bank statement, $450 7. Check for advertising expense, $230, incorrectly recorded in books as $320. 4B. Bank Reconciliation Components ldentify the requested amount in each of the following situations: a. MaryAnn Company's August 31 bank reconciliation shows deposits in transit of $2,250, The general ledger Cash in Bank account shows total cash receipts during September of $86,050. The September bank statement shows total cash deposits of $87,000 (and no credit memos). What amount of deposits in transit should appear in the September 30 bank reconciliation? onl roconciliation shows deposits in transit of $1.400. The

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts