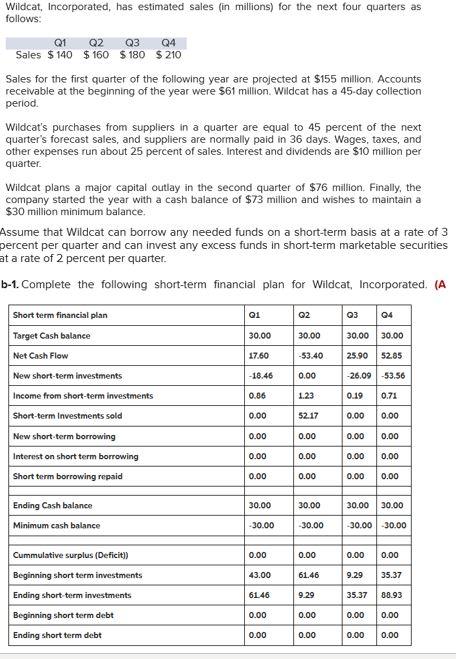

Question: Please show me how to get everything below net cash flow. I am not sure and I want to learn. The answers are given. Wildcat

Please show me how to get everything below net cash flow. I am not sure and I want to learn. The answers are given.

Wildcat , Incorporated, has estimated sales (in millions) for the next four quarters as follows: Q1 Q2 Q3 Q4 Sales $ 140 $ 160 $ 180 $ 210 Sales for the first quarter of the following year are projected at $155 million, Accounts receivable at the beginning of the year were $61 million. Wildcat has a 45-day collection period. Wildcat's purchases from suppliers in a quarter are equal to 45 percent of the next quarter's forecast sales, and suppliers are normally paid in 36 days. Wages, taxes, and other expenses run about 25 percent of sales. Interest and dividends are $10 million per quarter Wildcat plans a major capital outlay in the second quarter of $76 million. Finally, the company started the year with a cash balance of $73 million and wishes to maintain a $30 million minimum balance. Assume that Wildcat can borrow any needed funds on a short-term basis at a rate of 3 percent per quarter and can invest any excess funds in short-term marketable securities at a rate of 2 percent per quarter. b-1. Complete the following short-term financial plan for Wildcat, Incorporated. (A Q1 Q2 03 04 30.00 30.00 30.00 30.00 17.60 -53.40 25.90 52.85 -18.46 0.00 -26.09-53.56 Short term financial plan Target Cash balance Net Cash Flow New short-term investments Income from short-term investments Short-term Investments sold New short term borrowing Interest on short term borrowing Short term borrowing repaid 0.86 1.23 0.19 0.71 0.00 52.17 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 Ending Cash balance 30.00 30.00 30.00 30.00 Minimum cash balance -30.00 -30.00 -30.00 30.00 0.00 0.00 0.00 0.00 43.00 61.46 9.29 35.37 Cummulative surplus (Deficit)) Beginning short term investments Ending short-term investments Beginning short term debt Ending short term debt 6146 9.29 35.37 88.93 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 Wildcat , Incorporated, has estimated sales (in millions) for the next four quarters as follows: Q1 Q2 Q3 Q4 Sales $ 140 $ 160 $ 180 $ 210 Sales for the first quarter of the following year are projected at $155 million, Accounts receivable at the beginning of the year were $61 million. Wildcat has a 45-day collection period. Wildcat's purchases from suppliers in a quarter are equal to 45 percent of the next quarter's forecast sales, and suppliers are normally paid in 36 days. Wages, taxes, and other expenses run about 25 percent of sales. Interest and dividends are $10 million per quarter Wildcat plans a major capital outlay in the second quarter of $76 million. Finally, the company started the year with a cash balance of $73 million and wishes to maintain a $30 million minimum balance. Assume that Wildcat can borrow any needed funds on a short-term basis at a rate of 3 percent per quarter and can invest any excess funds in short-term marketable securities at a rate of 2 percent per quarter. b-1. Complete the following short-term financial plan for Wildcat, Incorporated. (A Q1 Q2 03 04 30.00 30.00 30.00 30.00 17.60 -53.40 25.90 52.85 -18.46 0.00 -26.09-53.56 Short term financial plan Target Cash balance Net Cash Flow New short-term investments Income from short-term investments Short-term Investments sold New short term borrowing Interest on short term borrowing Short term borrowing repaid 0.86 1.23 0.19 0.71 0.00 52.17 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 Ending Cash balance 30.00 30.00 30.00 30.00 Minimum cash balance -30.00 -30.00 -30.00 30.00 0.00 0.00 0.00 0.00 43.00 61.46 9.29 35.37 Cummulative surplus (Deficit)) Beginning short term investments Ending short-term investments Beginning short term debt Ending short term debt 6146 9.29 35.37 88.93 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts