Question: Please show me how to run this optimization in excel 1 . 3 Portfolio Analysis Alumni Affairs invests in three different funds to maintain diversity:

Please show me how to run this optimization in excel

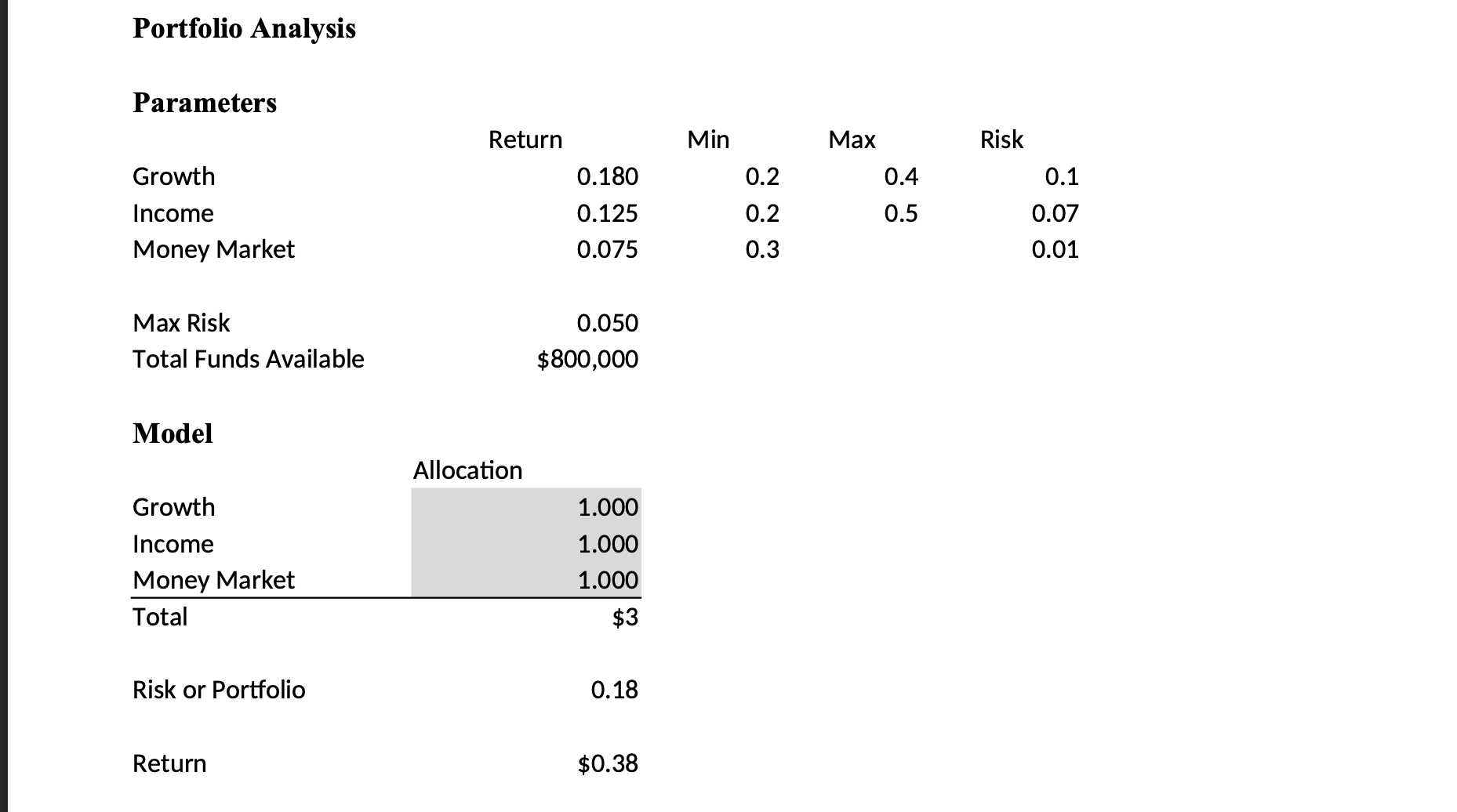

Portfolio Analysis

Alumni Affairs invests in three different funds to maintain diversity: a growth stock fund,

a money market fund and an income fund. Guidelines from the University Board of Directors

require that at least and no more than be invested in the growth fund, at least and

no more than be invested in the income fund and no less than be in the money market

fund.

The University Alumni Endowment has $ to invest and it has assigned the

following risks of losing money to each dollar invested in the funds: for growth; for

income and for money market. The University's risk tolerance is a maximum of on its

portfolio. The Bank of Charles Town Investment Service is forecasting annual yields of for

growth, for income and for money market. Your task is to create a linear

programming model that will maximize the return for the University subject to the constraints.

Business Plan

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock