Question: Please show me how to solve these using an excel spreadsheet Your firm needs to buy a new copier. The copier costs $4,000, but the

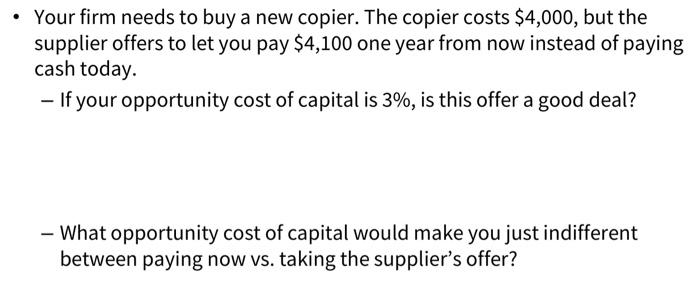

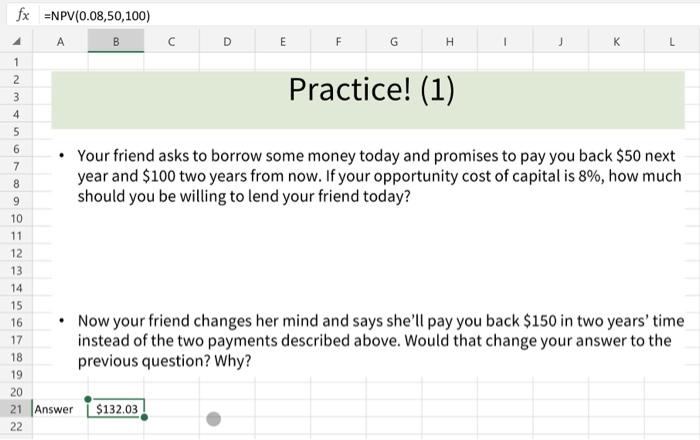

Your firm needs to buy a new copier. The copier costs $4,000, but the supplier offers to let you pay $4,100 one year from now instead of paying cash today. - If your opportunity cost of capital is 3%, is this offer a good deal? - What opportunity cost of capital would make you just indifferent between paying now vs. taking the supplier's offer? C D E F G H J K L Practice! (1) Your friend asks to borrow some money today and promises to pay you back $50 next year and $100 two years from now. If your opportunity cost of capital is 8%, how much should you be willing to lend your friend today? fx =NPV(0.08,50,100) A B 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 Answer $132.03 22 Now your friend changes her mind and says she'll pay you back $150 in two years' time instead of the two payments described above. Would that change your answer to the previous question? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts