Question: Please show me how to solve this E7-14 (Algo) Reporting Inventory at Lower of Cost or Market/Net Realizable Value (LO 7-4] Sandals Company is preparing

![Lower of Cost or Market/Net Realizable Value (LO 7-4] Sandals Company is](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/67160d158a079_38867160d14baf37.jpg)

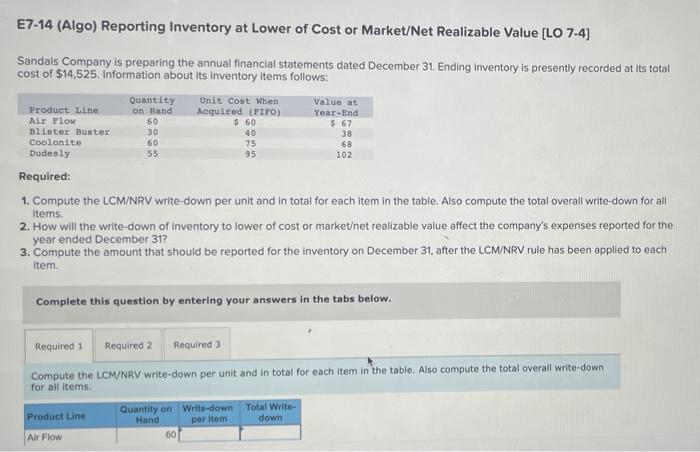

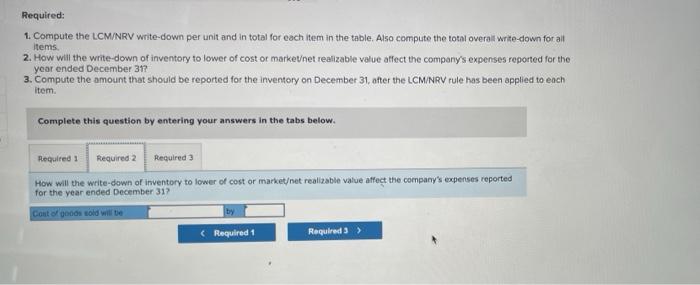

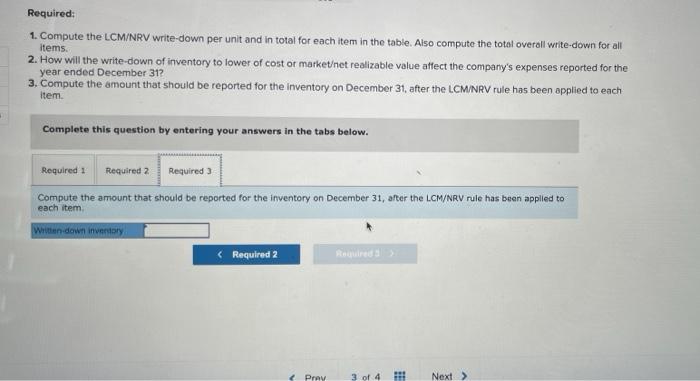

E7-14 (Algo) Reporting Inventory at Lower of Cost or Market/Net Realizable Value (LO 7-4] Sandals Company is preparing the annual financial statements dated December 31. Ending Inventory is presently recorded at its total cost of $14,525. Information about its inventory items follows: Product Line Air Flow Blister Buster Coolonite Dudesly Required: Quantity on Hand 60 30 60 55 Unit Cont When Acquired (YITO) $ 60 40 75 95 Value at Year-End $ 67 38 68 102 1. Compute the LCM/NRV write down per unit and in total for each item in the table. Also compute the total overall write-down for all items. 2. How will the write-down of inventory to lower of cost or marketet realizable value affect the company's expenses reported for the year ended December 312 3. Compute the amount that should be reported for the inventory on December 31, after the LCM/NRV rule has been applied to each item Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute the LCM/NRV write-down per unit and in total for each item in the table. Also compute the total overall write-down for all items Product Line Quantity on Write-down Hand per item Total Write down Air Flow Required: 1. Compute the LCM/NRV write-down per unit and in total for each item in the table. Also compute the total overall write-down for all Items. 2. How will the write-down of inventory to lower of cost or marketet realizable value affect the company's expenses reported for the year ended December 31? 3. Compute the amount that should be reported for the inventory on December 31, after the LCM/NRV rule has been applied to each Item. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute the LCM/NRV write-down per unit and in total for each item in the table. Also compute the total overall write-down for all items. Product Line Total Write- down Air Flow Blister Buster Coolonite Dudesly Total Quantity on Write-down Hand per item 60 30 60 55 Rould Reulred 2 > Required: 1. Compute the LCM/NRV write-down per unit and in total for each item in the table. Also compute the total overall write-down for all Items 2. How will the write-down of inventory to lower of cost or marketnet realizable value affect the company's expenses reported for the year ended December 317 3. Compute the amount that should be reported for the inventory on December 31, after the LCM/NRV rule has been applied to each item. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required How will the write-down of inventory to lower of cost or marketet realizable value affect the company's expenses reported for the year ended December 317 Cont of 0000 sold will be (Required 1 Required 3 > Required: 1. Compute the LCM/NRV write-down per unit and in total for each item in the table. Also compute the total overll write-down for all items. 2. How will the write-down of inventory to lower of cost or marketet realizable value affect the company's expenses reported for the year ended December 312 3. Compute the amount that should be reported for the inventory on December 31, after the LCMNRV rule has been applied to each item. Complete this question by entering your answers in the tabs below. Required: Required 2 Required) Compute the amount that should be reported for the inventory on December 31, after the LCM/NRV rule has been applied to each item Written down inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts