Question: Please show me how to solve this in Excel, step by step. >> V . E F 1 J K L R S 6 .

Please show me how to solve this in Excel, step by step.

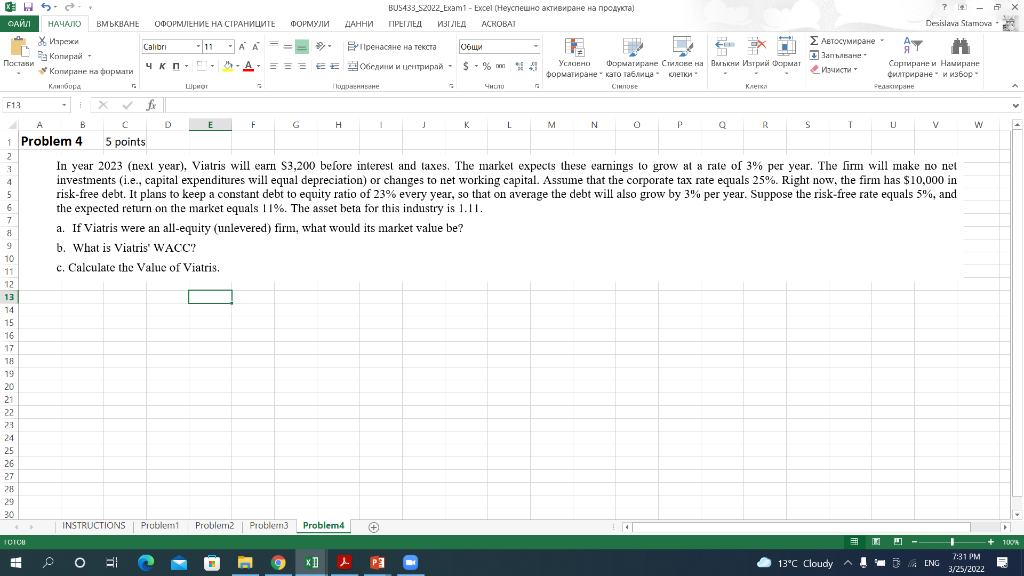

>> V . E F 1 J K L R S 6 . BU5433_S2022_Exam1 - Excel ( ) ? 1 x ACROBAT Desislava Stamora Calibri -11 2 * - . - + = = = = = = = $ - % S % " * " " F13 - B D G M M N Q R T T U V w 1 Problem 4 5 points 2 3 In year 2023 (next year), Viatris will earn $3,200 before interest and taxes. The market expects these earnings lo grow at a rate of 3% per year. The firm will make no net investments (i.e., capital expenditures will equal depreciation) or changes to net working capital. Assume that the corporate tax rate equals 25%. Right now, the firm has $10,000 in 5 risk-free debt. It plans to keep a constant debt to equity ratio of 23% every year, so that on average the debt will also grow by 3% per year. Suppose the risk-free rate equals 5%, and 6 6 the expected return on the market equals 11%. The asset beta for this industry is 1.11. 7 a. If Viatris were an all-equity (unlevered) firm, what would its market value be? 9 b. What is Viatris' WACC? 10 11 c. Calculate the value of Viatris. 4 13 88 INSTRUCTIONS Problem Problem2 Problem Problem4 # TUICU Ea 1 ! ] P3 a 13C Cloudy ENG 7:31 PM 3/25/2022 >> V . E F 1 J K L R S 6 . BU5433_S2022_Exam1 - Excel ( ) ? 1 x ACROBAT Desislava Stamora Calibri -11 2 * - . - + = = = = = = = $ - % S % " * " " F13 - B D G M M N Q R T T U V w 1 Problem 4 5 points 2 3 In year 2023 (next year), Viatris will earn $3,200 before interest and taxes. The market expects these earnings lo grow at a rate of 3% per year. The firm will make no net investments (i.e., capital expenditures will equal depreciation) or changes to net working capital. Assume that the corporate tax rate equals 25%. Right now, the firm has $10,000 in 5 risk-free debt. It plans to keep a constant debt to equity ratio of 23% every year, so that on average the debt will also grow by 3% per year. Suppose the risk-free rate equals 5%, and 6 6 the expected return on the market equals 11%. The asset beta for this industry is 1.11. 7 a. If Viatris were an all-equity (unlevered) firm, what would its market value be? 9 b. What is Viatris' WACC? 10 11 c. Calculate the value of Viatris. 4 13 88 INSTRUCTIONS Problem Problem2 Problem Problem4 # TUICU Ea 1 ! ] P3 a 13C Cloudy ENG 7:31 PM 3/25/2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts