Question: Please show me how to use a data table with the information above Q2. You have been assigned by a publisher to analyze the profitability

Please show me how to use a data table with the information above

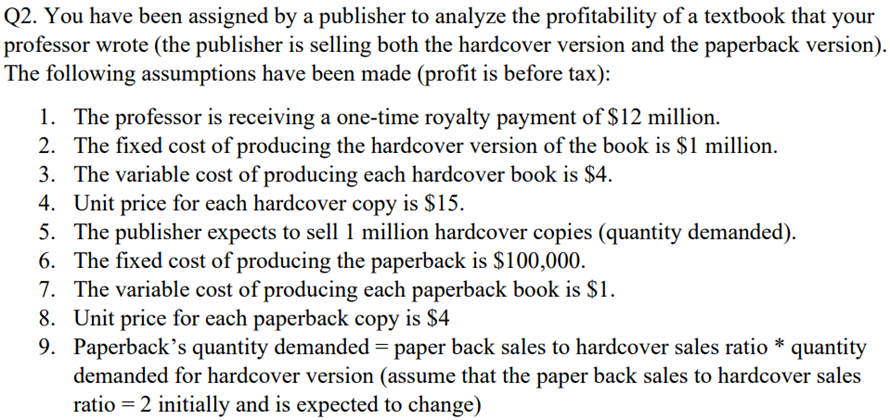

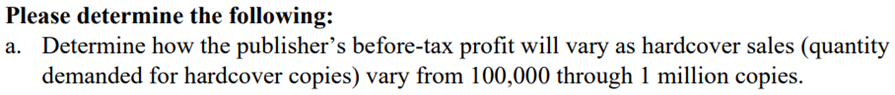

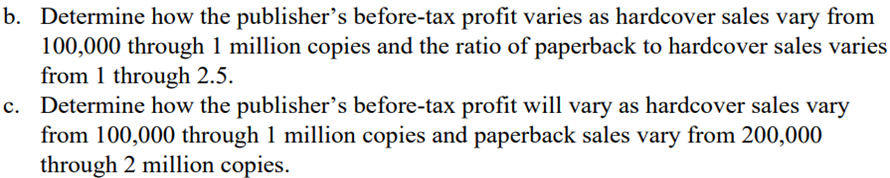

Q2. You have been assigned by a publisher to analyze the profitability of a textbook that your professor wrote (the publisher is selling both the hardcover version and the paperback version). The following assumptions have been made (profit is before tax): 1. The professor is receiving a one-time royalty payment of $12 million. 2. The fixed cost of producing the hardcover version of the book is $1 million. 3. The variable cost of producing each hardcover book is $4. 4. Unit price for each hardcover copy is $15. 5. The publisher expects to sell 1 million hardcover copies (quantity demanded). 6. The fixed cost of producing the paperback is $100,000. 7. The variable cost of producing each paperback book is $1. 8. Unit price for each paperback copy is $4 9. Paperback's quantity demanded = paper back sales to hardcover sales ratio * quantity demanded for hardcover version (assume that the paper back sales to hardcover sales ratio =2 initially and is expected to change) Please determine the following: a. Determine how the publisher's before-tax profit will vary as hardcover sales (quantity demanded for hardcover copies) vary from 100,000 through 1 million copies. Determine how the publisher's before-tax profit varies as hardcover sales vary from 100,000 through 1 million copies and the ratio of paperback to hardcover sales varies from 1 through 2.5 . Determine how the publisher's before-tax profit will vary as hardcover sales vary from 100,000 through 1 million copies and paperback sales vary from 200,000 through 2 million copies

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts