Question: Please show me how you do it on excel as well. 1. A $2,500 par value bond with annual payments has a current yield of

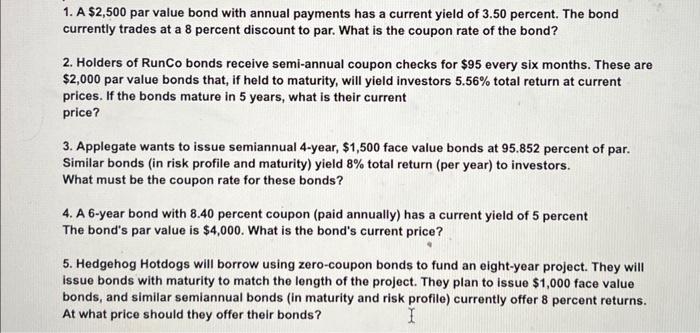

1. A $2,500 par value bond with annual payments has a current yield of 3.50 percent. The bond currently trades at a 8 percent discount to par. What is the coupon rate of the bond? 2. Holders of RunCo bonds receive semi-annual coupon checks for $95 every six months. These are $2,000 par value bonds that, if held to maturity, will yield investors 5.56% total return at current prices. If the bonds mature in 5 years, what is their current price? 3. Applegate wants to issue semiannual 4-year, $1,500 face value bonds at 95.852 percent of par. Similar bonds (in risk profile and maturity) yield 8% total return (per year) to investors. What must be the coupon rate for these bonds? 4. A 6-year bond with 8.40 percent coupon (paid annually) has a current yield of 5 percent The bond's par value is $4,000. What is the bond's current price? 5. Hedgehog Hotdogs will borrow using zero-coupon bonds to fund an eight-year project. They will issue bonds with maturity to match the length of the project. They plan to issue $1,000 face value bonds, and similar semiannual bonds (in maturity and risk profile) currently offer 8 percent returns. At what price should they offer their bonds? 1. A $2,500 par value bond with annual payments has a current yield of 3.50 percent. The bond currently trades at a 8 percent discount to par. What is the coupon rate of the bond? 2. Holders of RunCo bonds receive semi-annual coupon checks for $95 every six months. These are $2,000 par value bonds that, if held to maturity, will yield investors 5.56% total return at current prices. If the bonds mature in 5 years, what is their current price? 3. Applegate wants to issue semiannual 4-year, $1,500 face value bonds at 95.852 percent of par. Similar bonds (in risk profile and maturity) yield 8% total return (per year) to investors. What must be the coupon rate for these bonds? 4. A 6-year bond with 8.40 percent coupon (paid annually) has a current yield of 5 percent The bond's par value is $4,000. What is the bond's current price? 5. Hedgehog Hotdogs will borrow using zero-coupon bonds to fund an eight-year project. They will issue bonds with maturity to match the length of the project. They plan to issue $1,000 face value bonds, and similar semiannual bonds (in maturity and risk profile) currently offer 8 percent returns. At what price should they offer their bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts