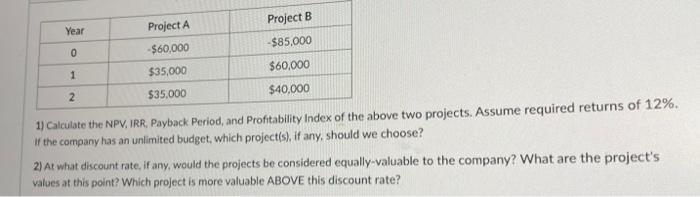

Question: Please show me how you do it on excel as well. 1) Calculate the NPV, IRR, Payback Period, and Profitability Index of the above two

1) Calculate the NPV, IRR, Payback Period, and Profitability Index of the above two projects. Assume required returns of 12%. If the company has an unlimited budget, which project(s), if any, should we choose? 2) At what discount rate, if any, would the projects be considered equally-valuable to the company? What are the project's values at this point? Which project is more valuable ABOVE this discount rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts