Question: Please show me how you would do it with formulas Value of a mixed stream. Harte Systems, Inc., a maker of electronic surveillance equipment, is

Please show me how you would do it with formulas

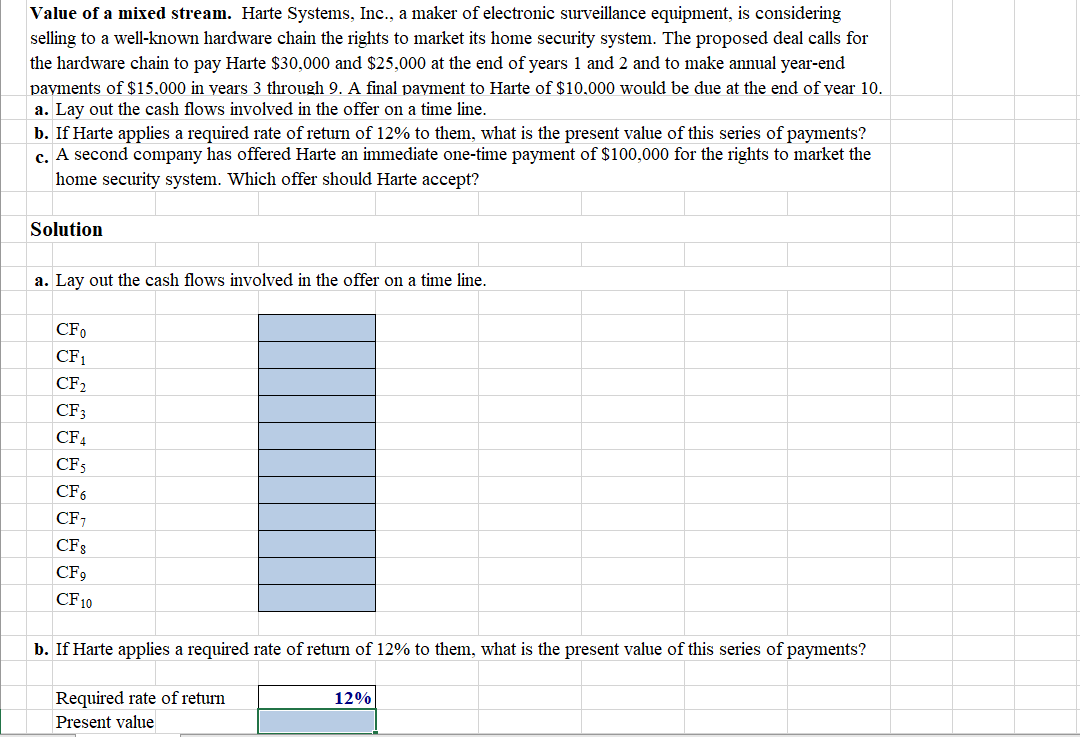

Value of a mixed stream. Harte Systems, Inc., a maker of electronic surveillance equipment, is considering selling to a well-known hardware chain the rights to market its home security system. The proposed deal calls for the hardware chain to pay Harte $30,000 and $25,000 at the end of years 1 and 2 and to make annual year-end payments of $15.000 in years 3 through 9. A final payment to Harte of $10,000 would be due at the end of year 10. a. Lay out the cash flows involved in the offer on a time line. b. If Harte applies a required rate of return of 12% to them, what is the present value of this series of payments? c. A second company has offered Harte an immediate one-time payment of $100,000 for the rights to market the home security system. Which offer should Harte accept? Solution a. Lay out the cash flows involved in the offer on a time line. CF. CF1 CF2 CF3 CF4 CFS CF6 CF; CFS CF9 CF 10 b. If Harte applies a required rate of return of 12% to them, what is the present value of this series of payments? 12% Required rate of return Present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts