Question: Please show me solution in detail.. You work for an Isracli company that is considering an investment in China's Sichuan province. The investment yields expected

Please show me solution in detail..

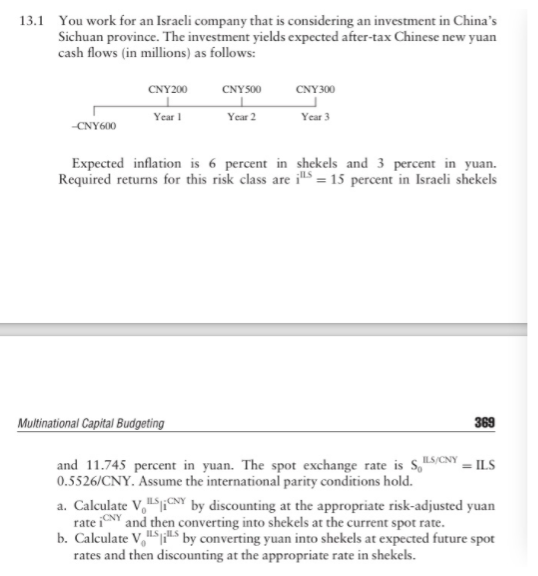

You work for an Isracli company that is considering an investment in China's Sichuan province. The investment yields expected after-tax Chinese new yuan cash flows (in millions) as follows: 13.1 CNY200 CNY50 CNY300 Year 3 CNY600 Expected inflation is 6 percent in sh Required returns for this risk class are ekels and 3 percent in yuan. 15 percent in Israeli shekels Multinational Capital Budgeting 369 and 11.745 percent in yuan. The spot exchange rate is SYIS 0.5526/CNY. Assume the international parity conditions hold. a. Calculate by discounting at the appropriate risk-adjusted yuan s b. Calculateby converting yuan into shekels at expected future spot rate i and then converting g into shekels at the current spot rate ILS ILS rates and then discounting at the a ppropriate rate in shekels. You work for an Isracli company that is considering an investment in China's Sichuan province. The investment yields expected after-tax Chinese new yuan cash flows (in millions) as follows: 13.1 CNY200 CNY50 CNY300 Year 3 CNY600 Expected inflation is 6 percent in sh Required returns for this risk class are ekels and 3 percent in yuan. 15 percent in Israeli shekels Multinational Capital Budgeting 369 and 11.745 percent in yuan. The spot exchange rate is SYIS 0.5526/CNY. Assume the international parity conditions hold. a. Calculate by discounting at the appropriate risk-adjusted yuan s b. Calculateby converting yuan into shekels at expected future spot rate i and then converting g into shekels at the current spot rate ILS ILS rates and then discounting at the a ppropriate rate in shekels

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts