Question: Please show me the answers prepared using excel. Question 2 will use the information from the pic that has spreads at the bottom of page.

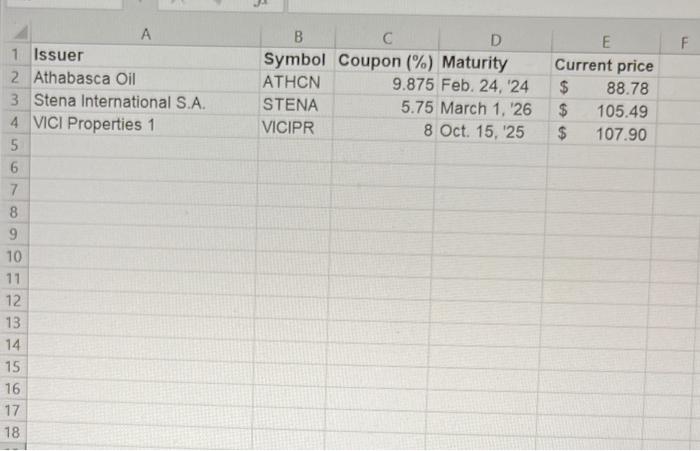

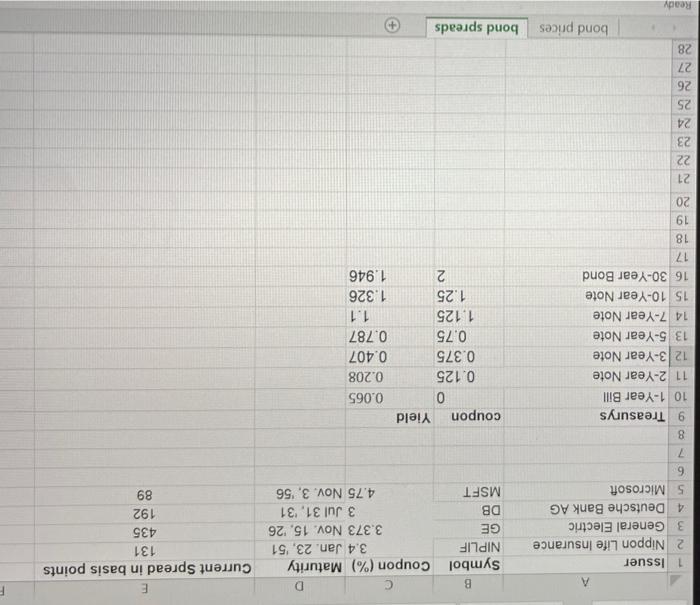

1. Look at the bond prices tab. Calculate the yield to maturity for each of the bonds. Par value is $100. Assume annual coupons and ignore the month and day info and just use the year to determine the number of periods. Create a data table with the YTM for Athabasca Oil bond as the output. The column input is the price, go from $80 to $110 in increments of $5, the row input is the coupon payment, go from $5 to $12 in increments of $1. MAKE SURE YOU PUT THE DATA TABLE ON THE HARD COPY YOU TURN IN What is the row with $100 input saying? What happens to the YTM as the price decreases and the coupon payment increases? 2. Look at the bond spreads tab. Calculate the YTM for each of the bonds. Calculate the current price for each of the bonds. Which bond had the highest price? Which bond had the lowest price? Create a data table with the Price for General Electric's bond as the output. The column input is the years to maturity, go from 0 to 5 in increments of 1, the row input is the coupon payment, go from $3 to $4.5 in increments of $0.5 3 B D Symbol Coupon (%) Maturity ATHCN 9.875 Feb. 24, '24 STENA 5.75 March 1, 26 VICIPR 8 Oct. 15, '25 E Current price $ 88.78 $ 105.49 $ 107.90 A 1 Issuer 2 Athabasca Oil 3 Stena International S.A. 4 VICI Properties 1 5 6 7 8 9 10 11 12 13 14 15 16 17 18 F A 1 Issuer 2 Nippon Life Insurance 3 General Electric 4 Deutsche Bank AG 5 Microsoft 6 B D Symbol Coupon (%) Maturity NIPLIF 3.4 Jan. 23, '51 3.373 Nov. 15. 26 DB 3 Jul 31, '31 MSFT 4.75 Nov. 3, '56 E Current Spread in basis points 131 435 192 89 GE 7 8 9 Treasurys 10 1-Year Bill 11 2-Year Note 123-Year Note 13. 5-Year Note 14 7-Year Note 15 10-Year Note 16 30-Year Bond 17 18 19 20 coupon Yield 0 0.125 0.375 0.75 1.125 1.25 2 0.065 0.208 0.407 0.787 1.1 1.326 1.946 21 22 23 24 25 26 27 28 bond prices bond spreads Ready

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts