Question: Please show me the specific calculations how to get this right. Question 2 Using Monte-Carlo simulation, evaluate the 90% quantile of the daily port- folio

Please show me the specific calculations how to get this right.

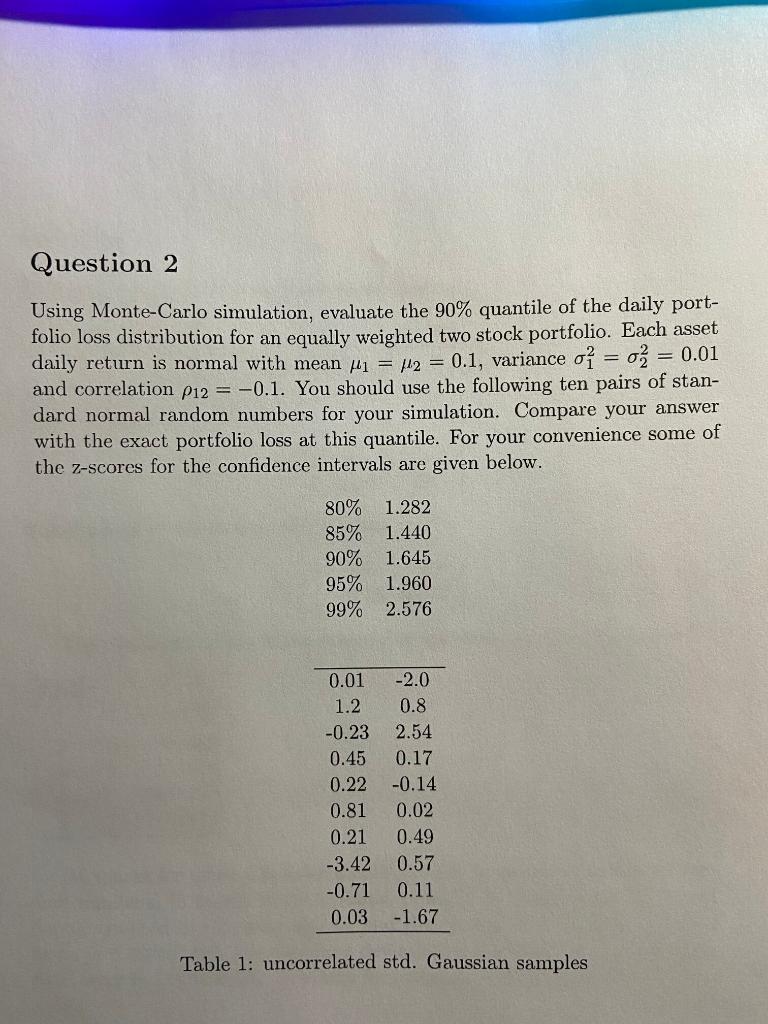

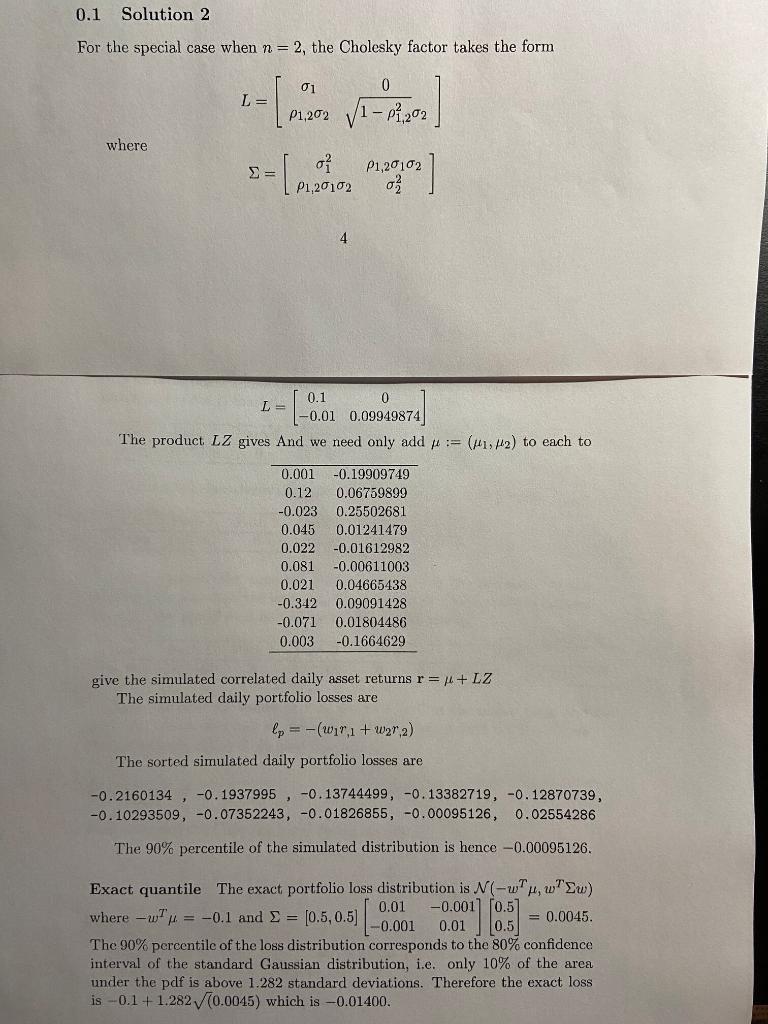

Question 2 Using Monte-Carlo simulation, evaluate the 90% quantile of the daily port- folio loss distribution for an equally weighted two stock portfolio. Each asset daily return is normal with mean H1 = M2 = 0.1, variance o = o = 0.01 and correlation 212 = -0.1. You should use the following ten pairs of stan- dard normal random numbers for your simulation. Compare your answer with the exact portfolio loss at this quantile. For your convenience some of the z-scores for the confidence intervals are given below. 80% 1.282 85% 1.440 90% 1.645 95% 1.960 99% 2.576 0.01 -2.0 1.2 0.8 -0.23 2.54 0.45 0.17 0.22 -0.14 0.81 0.02 0.21 0.49 -3.42 0.57 -0.71 0.11 0.03 -1.67 Table 1: uncorrelated std. Gaussian samples 0.1 Solution 2 For the special case when n = 2, the Cholesky factor takes the form 01 0 L= [. P1,202 1 - 02.202 where 01 21,20102 o 0.1 0 L = -0.01 0.09949874 The product LZ gives And we need only add p := (1, 2) to each to - [10:06 0.001 0.12 -0.023 0.045 0.022 0.081 0.021 -0.342 -0.071 0.003 -0.19909749 0.06759899 0.25502681 0.01241479 -0.01612982 -0.00611003 0.04665438 0.09091428 0.01804486 -0.1664629 give the simulated correlated daily asset returns r = {1+ LZ The simulated daily portfolio losses are lp = -(w11,1+ wzr2) The sorted simulated daily portfolio losses are -0.2160134 , -0.1937995, -0.13744499, -0.13382719, -0.12870739, -0.10293509, -0.07352243, -0.01826855, -0.00095126, 0.02554286 The 90% percentile of the simulated distribution is hence -0.00095126. 0.01 Exact quantile The exact portfolio loss distribution is N(-wH,w"Ew) where we = -0.1 and 2 = 10.5, 0.5) -0.001 -0.001] (0.5) "1 = 0.0045. 0.5 The 90% percentile of the loss distribution corresponds to the 80% confidence interval of the standard Gaussian distribution, i.e. only 10% of the area under the pdf is above 1.282 standard deviations. Therefore the exact loss is -0.1 +1.282 /(0.0045) which is -0.01400. Question 2 Using Monte-Carlo simulation, evaluate the 90% quantile of the daily port- folio loss distribution for an equally weighted two stock portfolio. Each asset daily return is normal with mean H1 = M2 = 0.1, variance o = o = 0.01 and correlation 212 = -0.1. You should use the following ten pairs of stan- dard normal random numbers for your simulation. Compare your answer with the exact portfolio loss at this quantile. For your convenience some of the z-scores for the confidence intervals are given below. 80% 1.282 85% 1.440 90% 1.645 95% 1.960 99% 2.576 0.01 -2.0 1.2 0.8 -0.23 2.54 0.45 0.17 0.22 -0.14 0.81 0.02 0.21 0.49 -3.42 0.57 -0.71 0.11 0.03 -1.67 Table 1: uncorrelated std. Gaussian samples 0.1 Solution 2 For the special case when n = 2, the Cholesky factor takes the form 01 0 L= [. P1,202 1 - 02.202 where 01 21,20102 o 0.1 0 L = -0.01 0.09949874 The product LZ gives And we need only add p := (1, 2) to each to - [10:06 0.001 0.12 -0.023 0.045 0.022 0.081 0.021 -0.342 -0.071 0.003 -0.19909749 0.06759899 0.25502681 0.01241479 -0.01612982 -0.00611003 0.04665438 0.09091428 0.01804486 -0.1664629 give the simulated correlated daily asset returns r = {1+ LZ The simulated daily portfolio losses are lp = -(w11,1+ wzr2) The sorted simulated daily portfolio losses are -0.2160134 , -0.1937995, -0.13744499, -0.13382719, -0.12870739, -0.10293509, -0.07352243, -0.01826855, -0.00095126, 0.02554286 The 90% percentile of the simulated distribution is hence -0.00095126. 0.01 Exact quantile The exact portfolio loss distribution is N(-wH,w"Ew) where we = -0.1 and 2 = 10.5, 0.5) -0.001 -0.001] (0.5) "1 = 0.0045. 0.5 The 90% percentile of the loss distribution corresponds to the 80% confidence interval of the standard Gaussian distribution, i.e. only 10% of the area under the pdf is above 1.282 standard deviations. Therefore the exact loss is -0.1 +1.282 /(0.0045) which is -0.01400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts