Question: please show me the steps problems A-C and show me the steps of how you found excess earnings, this is the 2nd time i post

please show me the steps problems A-C and show me the steps of how you found excess earnings, this is the 2nd time i post this question please show me the steps of you find the excess earnings. thank you!

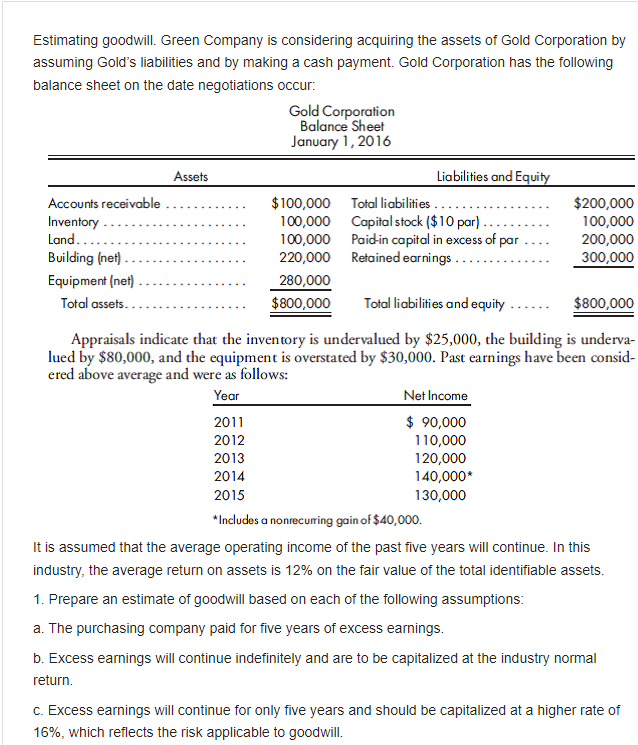

Estimating goodwill. Green Company is considering acquiring the assets of Gold Corporation by assuming Gold's liabilities and by making a cash payment. Gold Corporation has the following balance sheet on the date negotiations occur: Gold Corporation Balance Sheet January 1, 2016 Appraisals indicate that the inventory is undervalued by $25,000, the building is undervalued by $80,000, and the equipment is overstated by $30,000. Past earnings have been considered above average and were as follows: *Includes a nonrecurring gain of $40,000. It is assumed that the average operating income of the past five years will continue. In this industry, the average return on assets is 12% on the fair value of the total identifiable assets. 1. Prepare an estimate of goodwill based on each of the following assumptions: a. The purchasing company paid for five years of excess earnings. b. Excess earnings will continue indefinitely and are to be capitalized at the industry normal return. c. Excess earnings will continue for only five years and should be capitalized at a higher rate of 16%, which reflects the risk applicable to goodwill

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts