Question: please show only Basic EPS. I also attach the solution picture with the question. I dont understand that where are 350000 shares come from in

please show only Basic EPS. I also attach the solution picture with the question. I dont understand that where are 350000 shares come from in less dividends on $4.50 preferred in solution. and WAOS shares are from where?

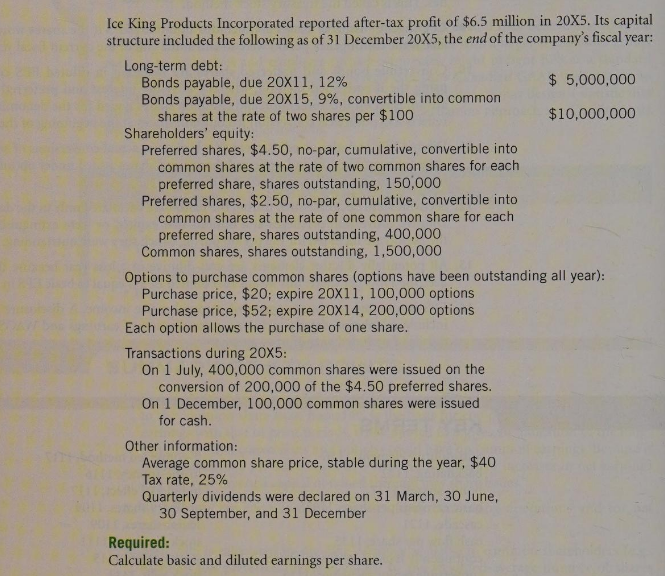

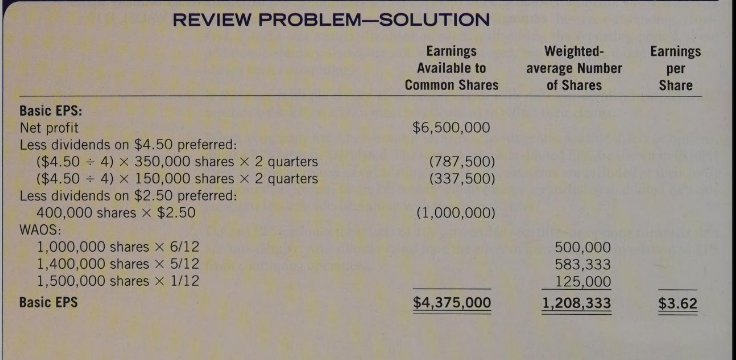

Ice King Products Incorporated reported after-tax profit of $6.5 million in 20X5. Its capital structure included the following as of 31 December 20X5, the end of the company's fiscal year: Long-term debt: Bonds payable, due 20x11, 12% $ 5,000,000 Bonds payable, due 20X15, 9%, convertible into common shares at the rate of two shares per $100 $10,000,000 Shareholders' equity: Preferred shares, $4.50, no-par, cumulative, convertible into common shares at the rate of two common shares for each preferred share, shares outstanding, 150,000 Preferred shares, $2.50, no-par, cumulative, convertible into common shares at the rate of one common share for each preferred share, shares outstanding, 400,000 Common shares, shares outstanding, 1,500,000 Options to purchase common shares (options have been outstanding all year): Purchase price, $20; expire 20x11,100,000 options Purchase price, $52: expire 20X14, 200,000 options Each option allows the purchase of one share. Transactions during 20X5: On 1 July, 400,000 common shares were issued on the conversion of 200,000 of the $4.50 preferred shares. On 1 December, 100,000 common shares were issued for cash. Other information: Average common share price, stable during the year, $40 Tax rate, 25% Quarterly dividends were declared on 31 March, 30 June, 30 September, and 31 December Required: Calculate basic and diluted earnings per share. REVIEW PROBLEM-SOLUTION Earnings Available to Common Shares Weighted- average Number of Shares Earnings per Share $6,500,000 (787,500) (337,500) Basic EPS: Net profit Less dividends on $4.50 preferred: ($4.50 - 4) X 350,000 shares X 2 quarters ($4.50 + 4) X 150,000 shares X 2 quarters Less dividends on $2.50 preferred: 400,000 shares X $2.50 WAOS: 1,000,000 shares X 6/12 1,400,000 shares x 5/12 1,500,000 shares x 1/12 Basic EPS (1,000,000) 500,000 583,333 125,000 1,208,333 $4,375,000 $3.62 Ice King Products Incorporated reported after-tax profit of $6.5 million in 20X5. Its capital structure included the following as of 31 December 20X5, the end of the company's fiscal year: Long-term debt: Bonds payable, due 20x11, 12% $ 5,000,000 Bonds payable, due 20X15, 9%, convertible into common shares at the rate of two shares per $100 $10,000,000 Shareholders' equity: Preferred shares, $4.50, no-par, cumulative, convertible into common shares at the rate of two common shares for each preferred share, shares outstanding, 150,000 Preferred shares, $2.50, no-par, cumulative, convertible into common shares at the rate of one common share for each preferred share, shares outstanding, 400,000 Common shares, shares outstanding, 1,500,000 Options to purchase common shares (options have been outstanding all year): Purchase price, $20; expire 20x11,100,000 options Purchase price, $52: expire 20X14, 200,000 options Each option allows the purchase of one share. Transactions during 20X5: On 1 July, 400,000 common shares were issued on the conversion of 200,000 of the $4.50 preferred shares. On 1 December, 100,000 common shares were issued for cash. Other information: Average common share price, stable during the year, $40 Tax rate, 25% Quarterly dividends were declared on 31 March, 30 June, 30 September, and 31 December Required: Calculate basic and diluted earnings per share. REVIEW PROBLEM-SOLUTION Earnings Available to Common Shares Weighted- average Number of Shares Earnings per Share $6,500,000 (787,500) (337,500) Basic EPS: Net profit Less dividends on $4.50 preferred: ($4.50 - 4) X 350,000 shares X 2 quarters ($4.50 + 4) X 150,000 shares X 2 quarters Less dividends on $2.50 preferred: 400,000 shares X $2.50 WAOS: 1,000,000 shares X 6/12 1,400,000 shares x 5/12 1,500,000 shares x 1/12 Basic EPS (1,000,000) 500,000 583,333 125,000 1,208,333 $4,375,000 $3.62

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts