Question: Please show or explain how you got the answers. 2. Cost of capital Your task is to find the cost of capital capital available. The

Please show or explain how you got the answers.

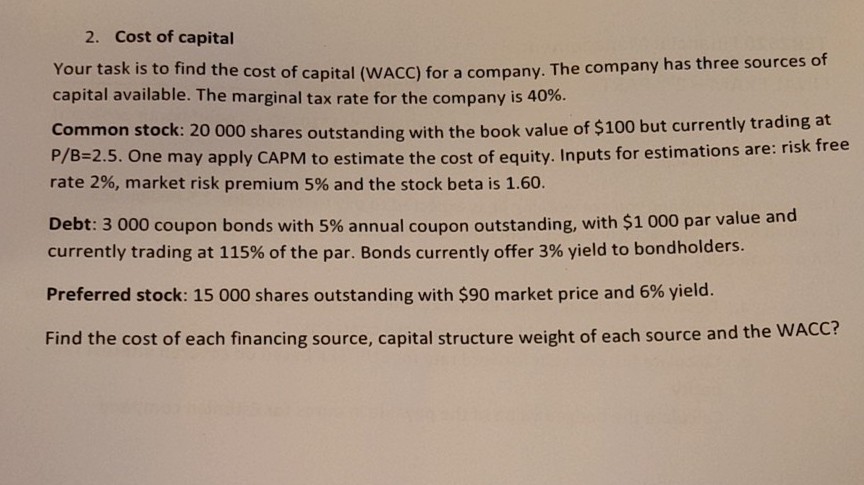

2. Cost of capital Your task is to find the cost of capital capital available. The marginal tax rate for the company is 40%. (WACC) for a company. The company has three sources of Common stock: 20 000 shares outstanding with the book value of $100 but currently trading at P/B=2.5. One may apply CAPM to estimate the cost of equity. Input rate 2%, market risk premium 5% and the stock beta is 1.60. s fo r estimations are: risk free Debt: 3 000 coupon bonds with 5% annual coupon outstanding, with $1000 par value and currently trading at 115% of the par. Bonds currently offer 3% yield to bondholders. Preferred stock: 15 000 shares outstanding with $90 market price and 6% yield. CC? Find the cost of each financing source, capital structure weight of each source and the WA

Step by Step Solution

There are 3 Steps involved in it

Given Data Tax Rate T 40 Common Stock Shares 20000 Book Value 100 PB Ratio 25 Market Price 100 25 25... View full answer

Get step-by-step solutions from verified subject matter experts