Question: Please show picture inputs for excel when answering. You must analyze a potential new product. The R & D department of Cori Materials has developed

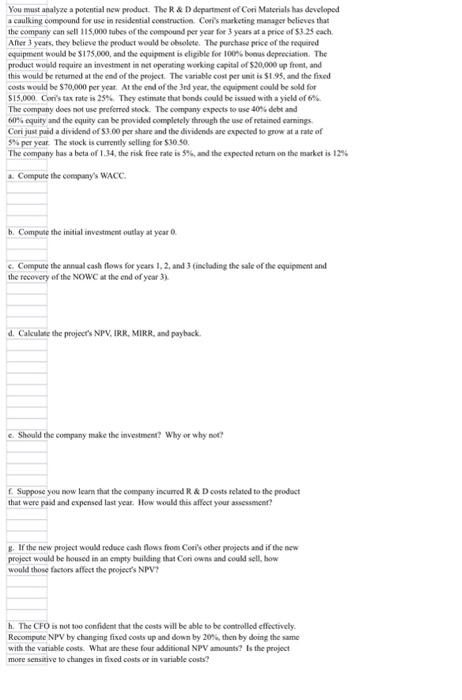

You must analyze a potential new product. The R \\& D department of Cori Materials has developed a caulking compound for use in fesidential constructive. Cers marketing manager believes that the eompany can sell 115,000 tubes of the compound per year for 3 years at a price of \\( \\$ 3.25 \\) each After 3 years, they believe the product would be covolete. The purchase price of the required eycipment would be \\( \\$ 175,000 \\), and the equipment is eligble for 100 s beras depeciation. The product would require an investment is net operating weeking capital of \\( \\$ 20,000 \\mathrm{sp} \\) ftumt, and this would be retumed at the end of the project. The variable cost per unit is \\( \\$ 1.95 \\), and the fixed costs would be \\( \\$ 70,000 \\) per year. At the end of the 3 rd year, the equipment could be sold for \\( \\$ 15,000 \\). Cori's tax rate is \25. They estimate that bonds ceould be iscued with a yield of \6. The company does not use preferred stock. The compuny expects to use \40 sebt and \60 equiry and the equity can be provided completely threagh the use of retained earnings. Ceri just paid a dividend of 53.00 per share and the dividends are expected to gow at a rate of 3\\% per year. The stock is currently selling for \\( \\$ 30.0 \\). The company bas a beta of 1,34 , the risk free rate is \5 and the expected refurn on the market is \12 a. Compute the compuay's WACC. b. Compuife the initial investment outlay at year 0 . c. Compute the annual cash flows for ycass 1,2, and 3 (inctading the sale of the equipenent and the recovery of the NOWC at the end of year 3i. d. Calculate the projecrs NPV, IRR, MIRR, and payback. c. Should the company make the investencen? Why or why noe? f. Suppose you now leam that the company iscurred R \\& D costs related to the product that were paid and expensed last year. How would this affect your assessencer? g. If the new project would redoce canh flows from Ceri's oether projects and if the new project would be housed in an empty bailding that Cori owns and could sell, how would those factors affect the project's NPV? h. The CFO is not too confident that the coass will be able to be controllod effectively. Recompute NPV by changing fixed costs up and down by \\( 20 \\mathrm{k} \\), then by doing the same with the variable costs. What are these four additional NPV amounts? Is the peoject more sensitive to changes in fixed costs or in variable costs? You must analyze a potential new product. The R \\& D department of Cori Materials has developed a caulking compound for use in fesidential constructive. Cers marketing manager believes that the eompany can sell 115,000 tubes of the compound per year for 3 years at a price of \\( \\$ 3.25 \\) each After 3 years, they believe the product would be covolete. The purchase price of the required eycipment would be \\( \\$ 175,000 \\), and the equipment is eligble for 100 s beras depeciation. The product would require an investment is net operating weeking capital of \\( \\$ 20,000 \\mathrm{sp} \\) ftumt, and this would be retumed at the end of the project. The variable cost per unit is \\( \\$ 1.95 \\), and the fixed costs would be \\( \\$ 70,000 \\) per year. At the end of the 3 rd year, the equipment could be sold for \\( \\$ 15,000 \\). Cori's tax rate is \25. They estimate that bonds ceould be iscued with a yield of \6. The company does not use preferred stock. The compuny expects to use \40 sebt and \60 equiry and the equity can be provided completely threagh the use of retained earnings. Ceri just paid a dividend of 53.00 per share and the dividends are expected to gow at a rate of 3\\% per year. The stock is currently selling for \\( \\$ 30.0 \\). The company bas a beta of 1,34 , the risk free rate is \5 and the expected refurn on the market is \12 a. Compute the compuay's WACC. b. Compuife the initial investment outlay at year 0 . c. Compute the annual cash flows for ycass 1,2, and 3 (inctading the sale of the equipenent and the recovery of the NOWC at the end of year 3i. d. Calculate the projecrs NPV, IRR, MIRR, and payback. c. Should the company make the investencen? Why or why noe? f. Suppose you now leam that the company iscurred R \\& D costs related to the product that were paid and expensed last year. How would this affect your assessencer? g. If the new project would redoce canh flows from Ceri's oether projects and if the new project would be housed in an empty bailding that Cori owns and could sell, how would those factors affect the project's NPV? h. The CFO is not too confident that the coass will be able to be controllod effectively. Recompute NPV by changing fixed costs up and down by \\( 20 \\mathrm{k} \\), then by doing the same with the variable costs. What are these four additional NPV amounts? Is the peoject more sensitive to changes in fixed costs or in variable costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts