Question: please, show properly what comes from where Q3. Case Construction Company, a three-year-old business, provides contracting and construction services to a variety of clients. Given

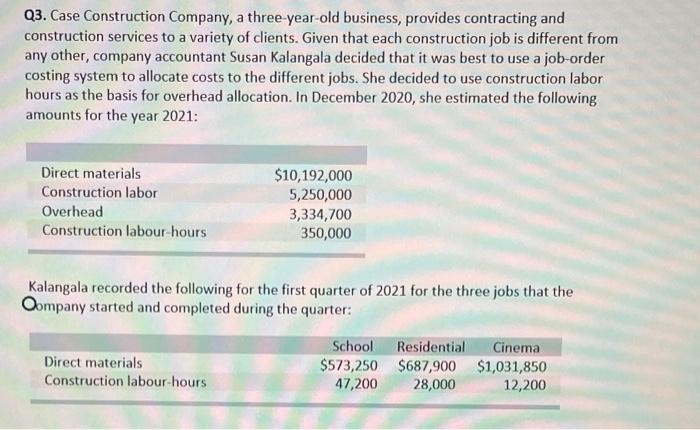

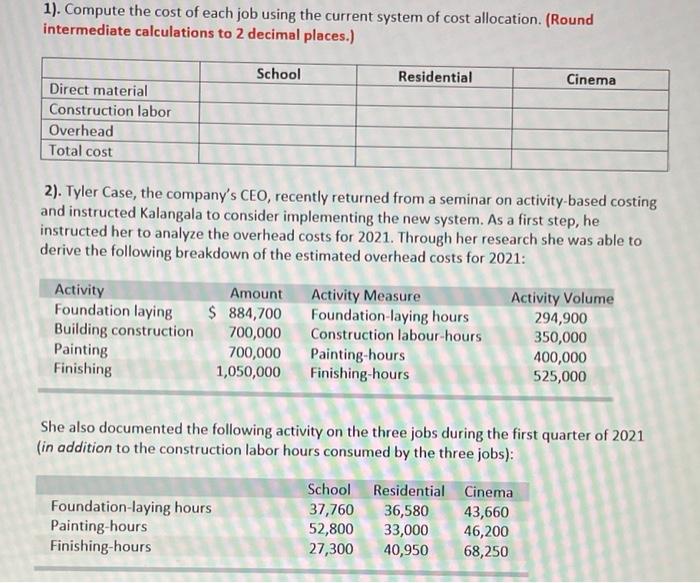

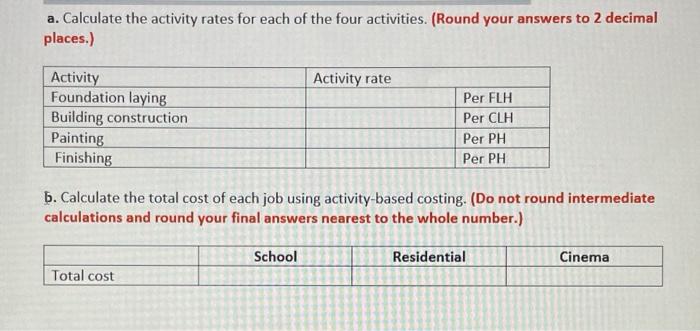

Q3. Case Construction Company, a three-year-old business, provides contracting and construction services to a variety of clients. Given that each construction job is different from any other, company accountant Susan Kalangala decided that it was best to use a job-order costing system to allocate costs to the different jobs. She decided to use construction labor hours as the basis for overhead allocation. In December 2020, she estimated the following amounts for the year 2021: Kalangala recorded the following for the first quarter of 2021 for the three jobs that the Oompany started and completed during the quarter: 1). Compute the cost of each job using the current system of cost allocation. (Round intermediate calculations to 2 decimal places.) 2). Tyler Case, the company's CEO, recently returned from a seminar on activity-based costing and instructed Kalangala to consider implementing the new system. As a first step, he instructed her to analyze the overhead costs for 2021 . Through her research she was able to derive the following breakdown of the estimated overhead costs for 2021: She also documented the following activity on the three jobs during the first quarter of 2021 (in addition to the construction labor hours consumed by the three jobs): a. Calculate the activity rates for each of the four activities. (Round your answers to 2 decimal places.) b. Calculate the total cost of each job using activity-based costing. (Do not round intermediate calculations and round your final answers nearest to the whole number.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts