Question: please show relevant formulas and explain how they work. i need to understand how to do the problem to give a positive rating A 120

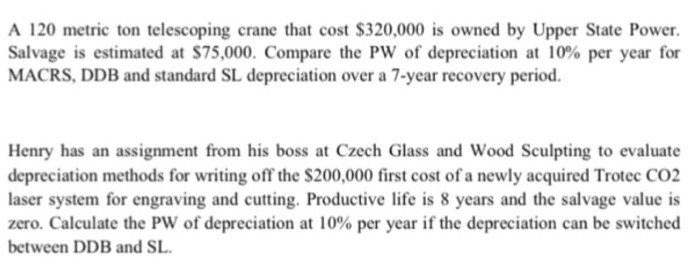

A 120 metric ton telescoping crane that cost $320,000 is owned by Upper State Power. Salvage is estimated at $75,000. Compare the PW of depreciation at 10% per year for MACRS, DDB and standard SL depreciation over a 7-year recovery period. Henry has an assignment from his boss at Czech Glass and Wood Sculpting to evaluate depreciation methods for writing off the $200,000 first cost of a newly acquired Trotec CO2 laser system for engraving and cutting. Productive life is 8 years and the salvage value is zero. Calculate the PW of depreciation at 10% per year if the depreciation can be switched between DDB and SL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts