Question: please show simple work. Input area: 8.5% Bond X: Coupon rate Yield to maturity Settlement date Maturity date Maturity date Maturity date Maturity date Maturity

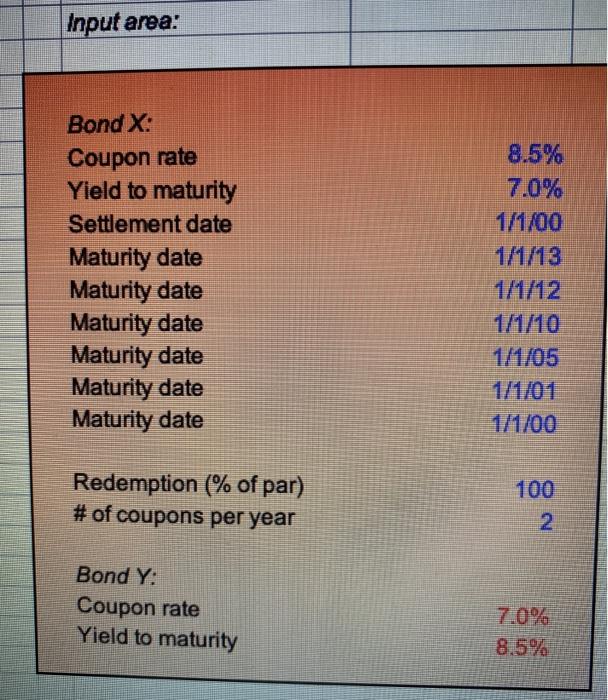

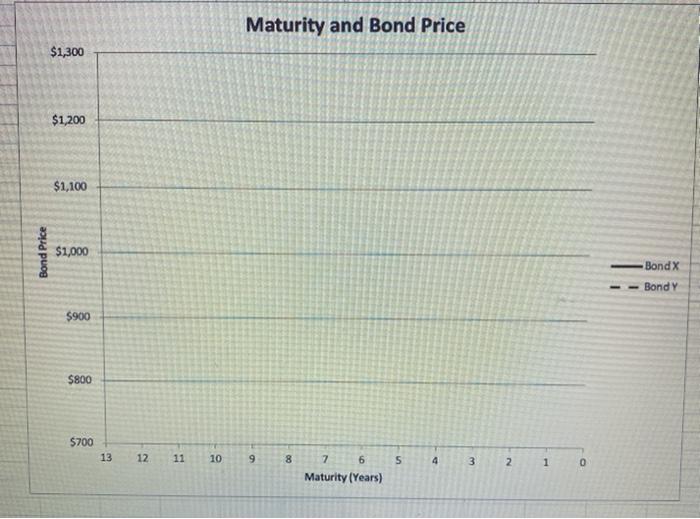

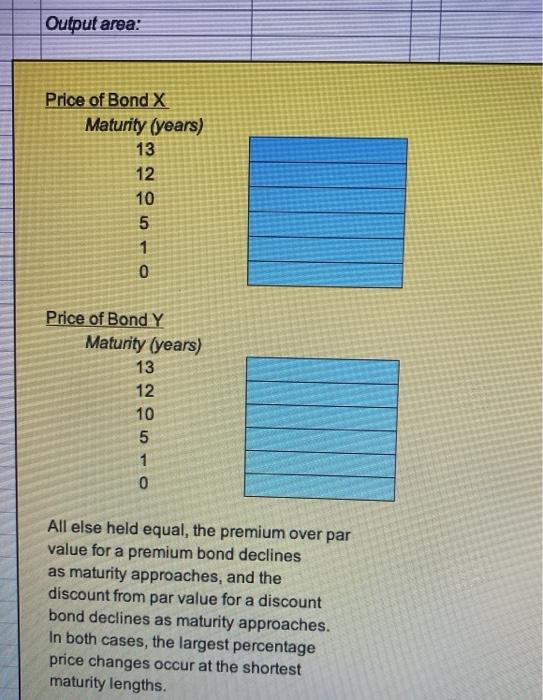

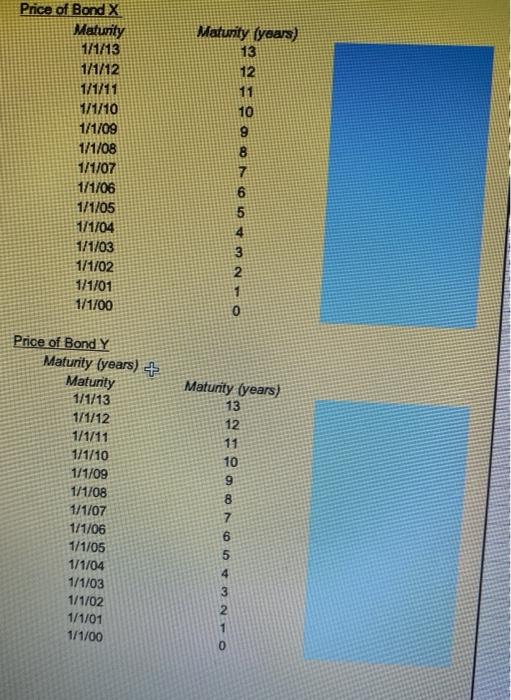

Input area: 8.5% Bond X: Coupon rate Yield to maturity Settlement date Maturity date Maturity date Maturity date Maturity date Maturity date Maturity date 1/1/00 1/1/13 1/1/12 1/1/10 1/1/05 1/1/01 1/1/00 Redemption (% of par) # of coupons per year 100 2 Bond Y: Coupon rate Yield to maturity 7.0% 8.5% Maturity and Bond Price $1,300 $1,200 $1,100 Bond Price $1,000 Bond X Bond Y 1 $900 $800 $700 13 12 11 10 9 8 5 4 3 2 1 0 7 6 Maturity (Years) Output area: Price of Bond X Maturity (years) 13 12 10 5 1 0 Price of Bond Y Maturity (years) 13 10 5 1 All else held equal, the premium over par value for a premium bond declines as maturity approaches, and the discount from par value for a discount bond declines as maturity approaches. In both cases, the largest percentage price changes occur at the shortest maturity lengths. Price of Bond X Maturity 171/13 1/1/12 171211 1/1/10 1/1/09 1/1/08 1/1/07 1/1/06 1/1/05 1/1/04 1/1/03 1/1/02 1/1/01 1/1/00 Maturity (years) 13 12 11 10 9 8 7 6 5 ON Matunity (years) Price of Bond Y Maturity (years) + Maturity 1/1/13 1/1/12 1/1/11 1/1/10 1/1/09 1/1/08 1/1/07 1/1/06 1/1/05 1/1/04 1/1/03 1/1/02 1/1/01 1/1/00 13 12 11 10 9 8 7 NW Aonoveco 4 2 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts