Question: please show solution using excel Beatrice Markets is expecting a period of intense growth and has decided to retain more of its earnings to help

please show solution using excel

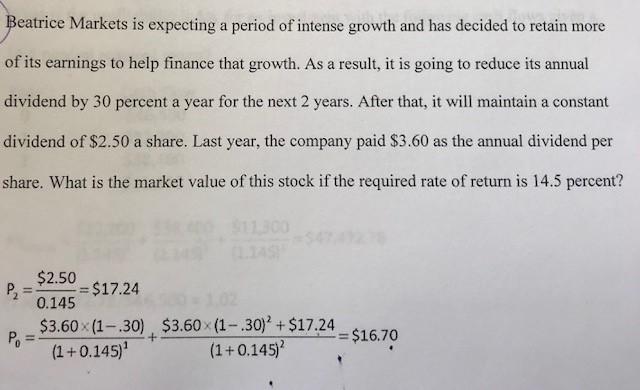

Beatrice Markets is expecting a period of intense growth and has decided to retain more of its earnings to help finance that growth. As a result, it is going to reduce its annual dividend by 30 percent a year for the next 2 years. After that, it will maintain a constant dividend of $2.50 a share. Last year, the company paid $3.60 as the annual dividend per share. What is the market value of this stock if the required rate of return is 14.5 percent? $2.50 P = $17.24 0.145 $3.60X (1-30) $3.60 (1-.30) +$17.24 Po = + = $16.70 (1 +0.145) (1+0.145)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts