Question: Please show step by step and show the impact on the accounting equation, thank you! On 8/1/21, XYZ paid KLM 36,000 for a 2 year

Please show step by step and show the impact on the accounting equation, thank you!

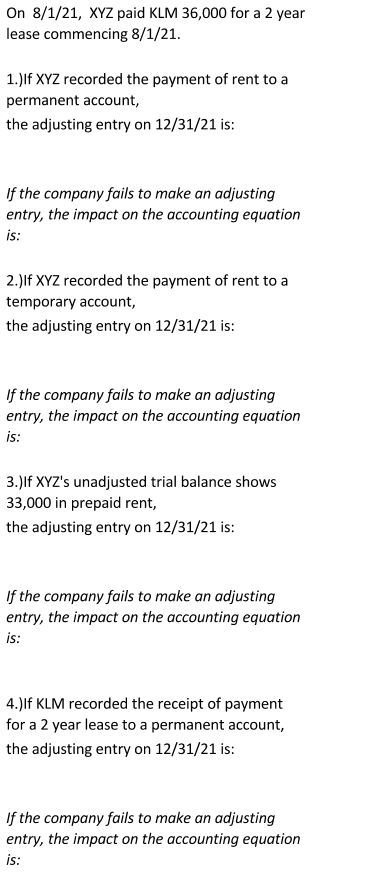

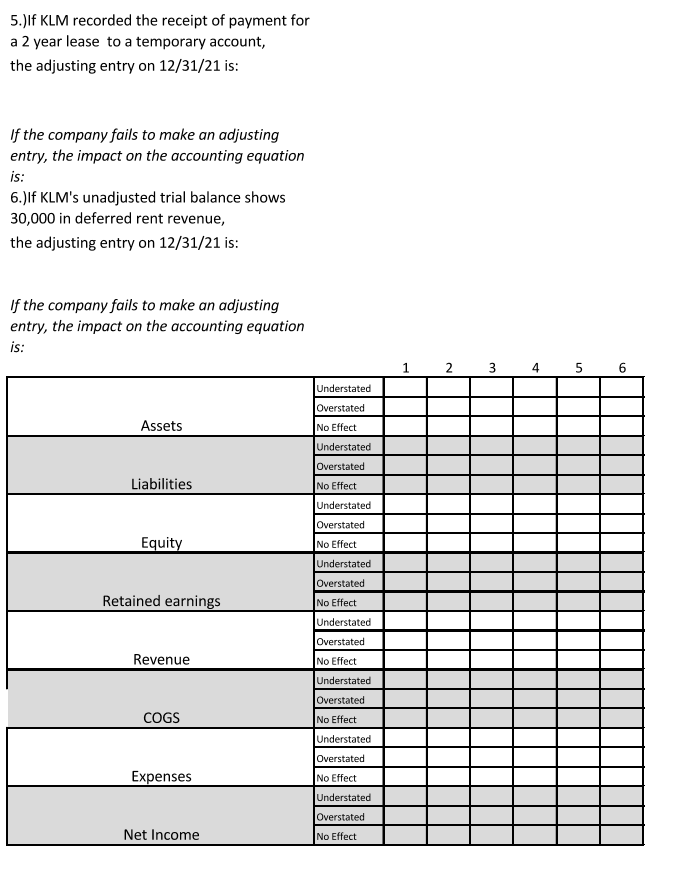

On 8/1/21, XYZ paid KLM 36,000 for a 2 year lease commencing 8/1/21. 1.)If XYZ recorded the payment of rent to a permanent account, the adjusting entry on 12/31/21 is: If the company fails to make an adjusting entry, the impact on the accounting equation is: 2.) If XYZ recorded the payment of rent to a temporary account, the adjusting entry on 12/31/21 is: If the company fails to make an adjusting entry, the impact on the accounting equation is: 3.)If XYZ's unadjusted trial balance shows 33,000 in prepaid rent, the adjusting entry on 12/31/21 is: If the company fails to make an adjusting entry, the impact on the accounting equation is: 4.)If KLM recorded the receipt of payment for a 2 year lease to a permanent account, the adjusting entry on 12/31/21 is: If the company fails to make an adjusting entry, the impact on the accounting equation is: 5.)If KLM recorded the receipt of payment for a 2 year lease to a temporary account, the adjusting entry on 12/31/21 is: If the company fails to make an adjusting entry, the impact on the accounting equation is: 6.)If KLM's unadjusted trial balance shows 30,000 in deferred rent revenue, the adjusting entry on 12/31/21 is: If the company fails to make an adjusting entry, the impact on the accounting equation is: 1 2 3 4 5 6 Understated Overstated Assets No Effect Understated Liabilities Equity Overstated No Effect Understated Overstated No Effect Understated Overstated No Effect Understated Overstated No Effect Retained earnings Revenue Understated Overstated COGS No Effect Understated Overstated No Effect Expenses Understated Overstated Net Income No Effect On 8/1/21, XYZ paid KLM 36,000 for a 2 year lease commencing 8/1/21. 1.)If XYZ recorded the payment of rent to a permanent account, the adjusting entry on 12/31/21 is: If the company fails to make an adjusting entry, the impact on the accounting equation is: 2.) If XYZ recorded the payment of rent to a temporary account, the adjusting entry on 12/31/21 is: If the company fails to make an adjusting entry, the impact on the accounting equation is: 3.)If XYZ's unadjusted trial balance shows 33,000 in prepaid rent, the adjusting entry on 12/31/21 is: If the company fails to make an adjusting entry, the impact on the accounting equation is: 4.)If KLM recorded the receipt of payment for a 2 year lease to a permanent account, the adjusting entry on 12/31/21 is: If the company fails to make an adjusting entry, the impact on the accounting equation is: 5.)If KLM recorded the receipt of payment for a 2 year lease to a temporary account, the adjusting entry on 12/31/21 is: If the company fails to make an adjusting entry, the impact on the accounting equation is: 6.)If KLM's unadjusted trial balance shows 30,000 in deferred rent revenue, the adjusting entry on 12/31/21 is: If the company fails to make an adjusting entry, the impact on the accounting equation is: 1 2 3 4 5 6 Understated Overstated Assets No Effect Understated Liabilities Equity Overstated No Effect Understated Overstated No Effect Understated Overstated No Effect Understated Overstated No Effect Retained earnings Revenue Understated Overstated COGS No Effect Understated Overstated No Effect Expenses Understated Overstated Net Income No Effect

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts