Question: Please show step by step calculation the expected return on Bank of America and Walmart in the question above and solve part (c). Indicative answers

Please show step by step calculation the expected return on Bank of America and Walmart in the question above and solve part (c). Indicative answers are given

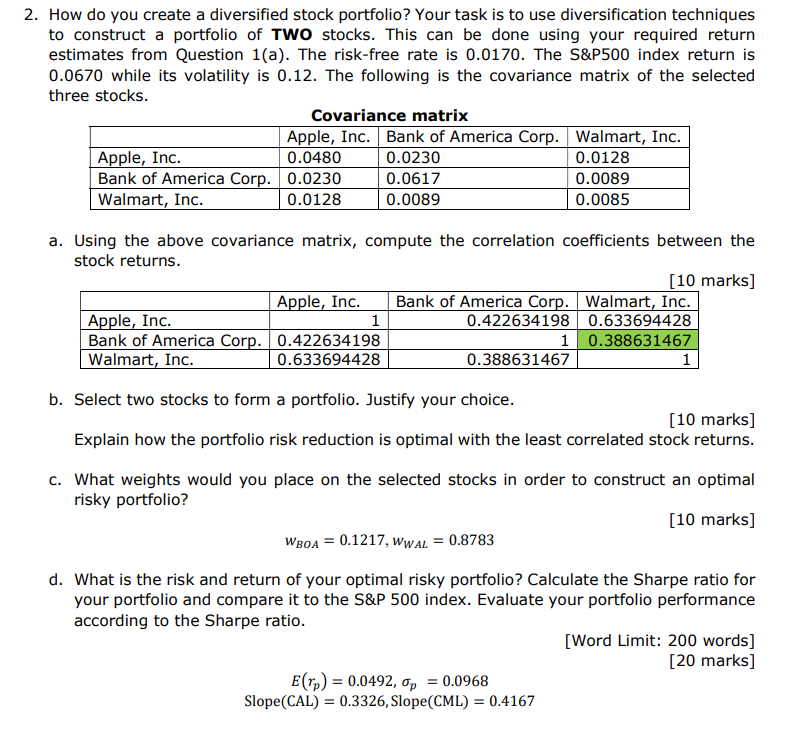

2. How do you create a diversified stock portfolio? Your task is to use diversification techniques to construct a portfolio of two stocks. This can be done using your required return estimates from Question 1(a). The risk-free rate is 0.0170. The S&P500 index return is 0.0670 while its volatility is 0.12. The following is the covariance matrix of the selected three stocks. Covariance matrix Apple, Inc. Bank of America Corp. Walmart, Inc. Apple, Inc. 0.0480 0.0230 0.0128 Bank of America Corp. 0.0230 0.0617 0.0089 Walmart, Inc. 0.0128 0.0089 0.0085 a. Using the above covariance matrix, compute the correlation coefficients between the stock returns. [10 marks] Apple, Inc. Bank of America Corp. Walmart, Inc. Apple, Inc. 1 0.422634198 0.633694428 Bank of America Corp. 0.422634198 1 0.388631467 Walmart, Inc. 0.633694428 0.388631467 1 b. Select two stocks to form a portfolio. Justify your choice. [10 marks] Explain how the portfolio risk reduction is optimal with the least correlated stock returns. C. What weights would you place on the selected stocks in order to construct an optimal risky portfolio? [10 marks] WBOA = 0.1217, WWAL = 0.8783 d. What is the risk and return of your optimal risky portfolio? Calculate the Sharpe ratio for your portfolio and compare it to the S&P 500 index. Evaluate your portfolio performance according to the Sharpe ratio. [Word Limit: 200 words] [20 marks] E(rp) = 0.0492, Op = 0.0968 Slope(CAL) = 0.3326, Slope(CML) = 0.4167

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts