Question: Please show step by step calculations where applicable. Thanks Question 12 4p Which of the following statements is CORRECT? If a project with normal cash

Please show step by step calculations where applicable. Thanks

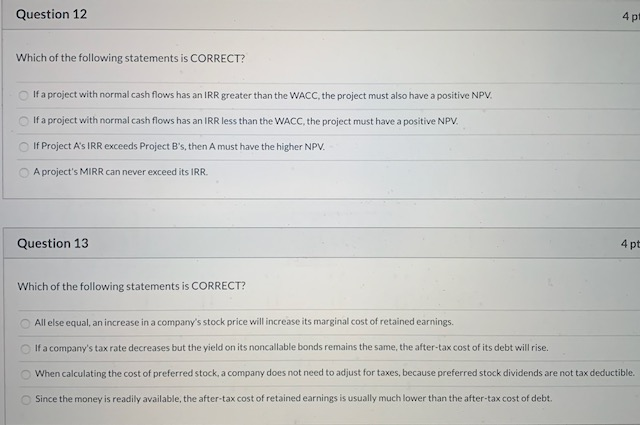

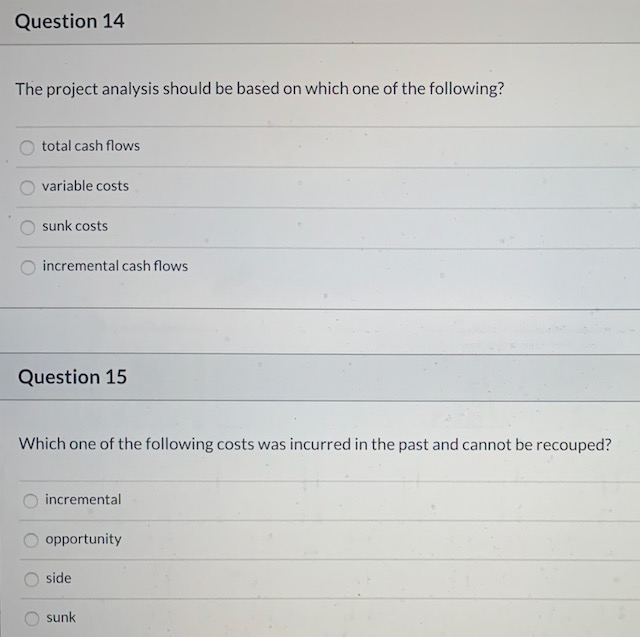

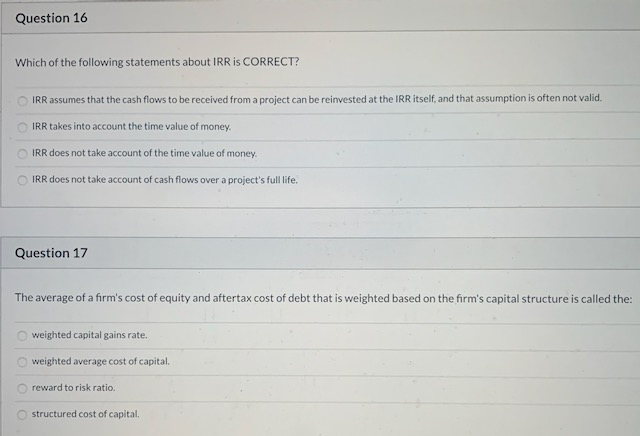

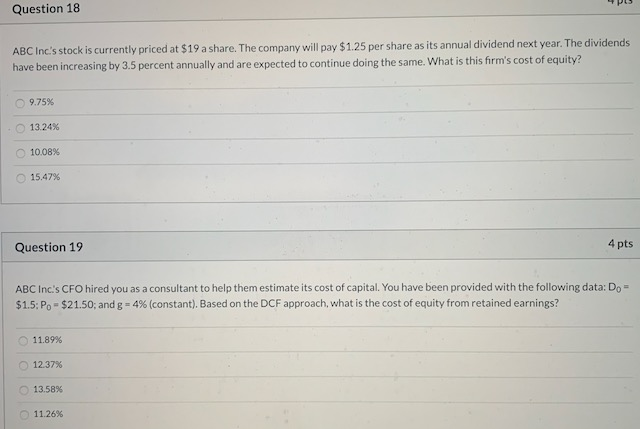

Question 12 4p Which of the following statements is CORRECT? If a project with normal cash flows has an IRR greater than the WACC, the project must also have a positive NPV. If a project with normal cash flows has an IRR less than the WACC, the project must have a positive NPV. If Project A's IRR exceeds Project B's, then A must have the higher NPV. A project's MIRR can never exceed its IRR. Question 13 4 pt Which of the following statements is CORRECT? All else equal, an increase in a company's stock price will increase its marginal cost of retained earnings. If a company's tax rate decreases but the yield on its noncallable bonds remains the same, the after-tax cost of its debt will rise. When calculating the cost of preferred stock, a company does not need to adjust for taxes, because preferred stock dividends are not tax deductible Since the money is readily available, the after-tax cost of retained earnings is usually much lower than the after-tax cost of debt. Question 14 The project analysis should be based on which one of the following? total cash flows sunk costs incremental cash flows Question 15 Which one of the following costs was incurred in the past and cannot be recouped? incremental opportunity side sunk Question 16 Which of the following statements about IRR is CORRECT? IRR assumes that the cash flows to be received from a project can be reinvested at the IRR itself, and that assumption is often not valid. IRR takes into account the time value of money. IRR does not take account of the time value of money. IRR does not take account of cash flows over a project's full life. Question 17 The average of a firm's cost of equity and aftertax cost of debt that is weighted based on the firm's capital structure is called the: weighted capital gains rate. weighted average cost of capital. reward to risk ratio. structured cost of capital. Question 18 ABC Inc's stock is currently priced at $19 a share. The company will pay $1.25 per share as its annual dividend next year. The dividends have been increasing by 3.5 percent annually and are expected to continue doing the same. What is this firm's cost of equity? 9.75% 13.24% 10.08% 15.47% Question 19 4 pts ABC Inc.'s CFO hired you as a consultant to help them estimate its cost of capital. You have been provided with the following data: Do - $1.5: Po - $21.50; and g - 4% (constant). Based on the DCF approach, what is the cost of equity from retained earnings? 11.89% 12.37% 13.58% 11.26%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts