Question: please show step by step how it got to this answer At the beginning of the year, Springfield Manufacturing had the following account balances: Work-in

please show step by step how it got to this answer

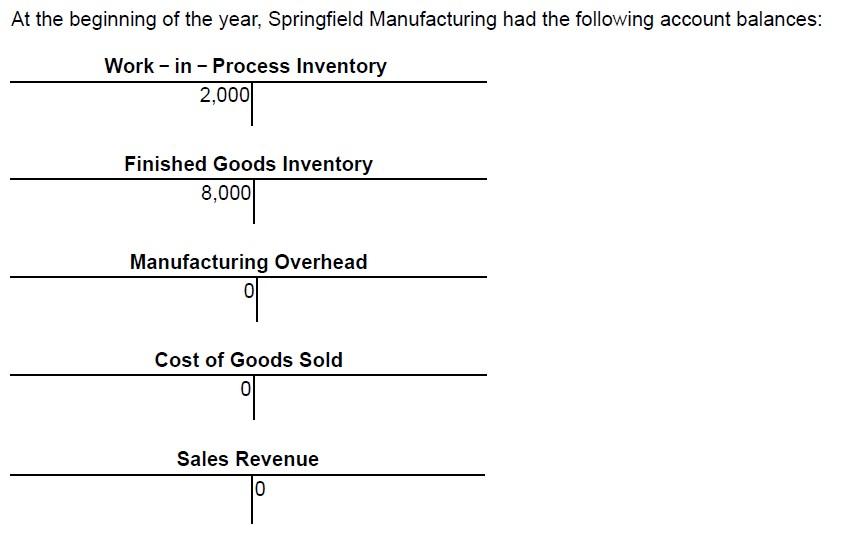

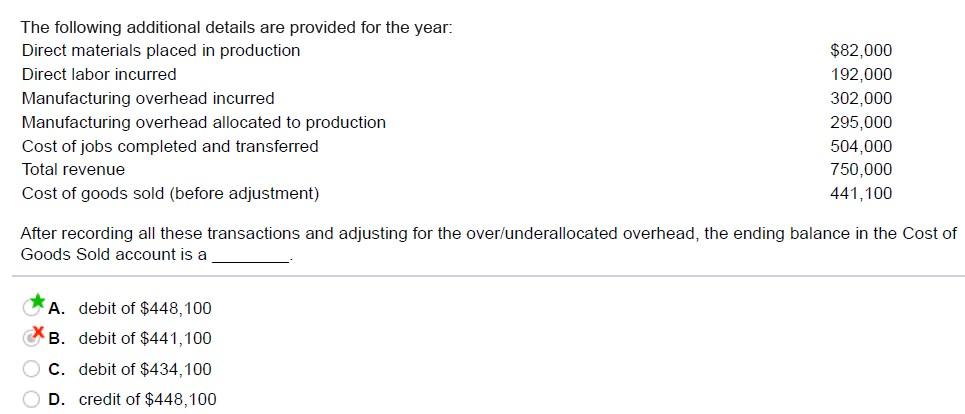

At the beginning of the year, Springfield Manufacturing had the following account balances: Work-in - Process Inventory 2,000 Finished Goods Inventory 8,000 Manufacturing Overhead Cost of Goods Sold 0 Sales Revenue 10 The following additional details are provided for the year: Direct materials placed in production $82,000 Direct labor incurred 192,000 Manufacturing overhead incurred 302,000 Manufacturing overhead allocated to production 295,000 Cost of jobs completed and transferred 504,000 Total revenue 750,000 Cost of goods sold (before adjustment) 441,100 After recording all these transactions and adjusting for the over/underallocated overhead, the ending balance in the Cost of Goods Sold account is a A. debit of $448, 100 X B. debit of $441,100 OC. debit of $434,100 OD. credit of $448,100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts