Question: Please show step by step how to solve using TVM functions in a CALULATOR and NOT EXCEL. answer choices are a. 23.59% b. 18.49% c.

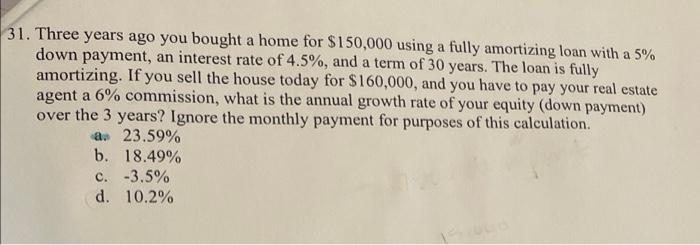

31. Three years ago you bought a home for $150,000 using a fully amortizing loan with a 5% down payment, an interest rate of 4.5%, and a term of 30 years. The loan is fully amortizing. If you sell the house today for $160,000, and you have to pay your real estate agent a 6% commission, what is the annual growth rate of your equity (down payment) over the 3 years? Ignore the monthly payment for purposes of this calculation. a. 23.59% b. 18.49% c.-3.5% d. 10.2%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts