Question: please show step by step solution 10) In 2017, Dooling Corporation acquired Oxford Inc, for $250 million, of which $45 million was attributed to goodwill.

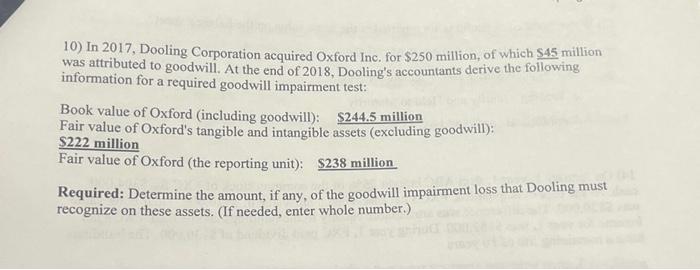

10) In 2017, Dooling Corporation acquired Oxford Inc, for $250 million, of which $45 million was attributed to goodwill. At the end of 2018 , Dooling's accountants derive the following information for a required goodwill impairment test: Book value of Oxford (including goodwill): $244.5 million Fair value of Oxford's tangible and intangible assets (excluding goodwill): S222 million Fair value of Oxford (the reporting unit): $238 million Required: Determine the amount, if any, of the goodwill impairment loss that Dooling must recognize on these assets. (If needed, enter whole number.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts