Question: please show step by step step by step please Poes of Accounting (ACCT 232.03) structor Thane Final Exam - May 7.2022 - 10 AM to

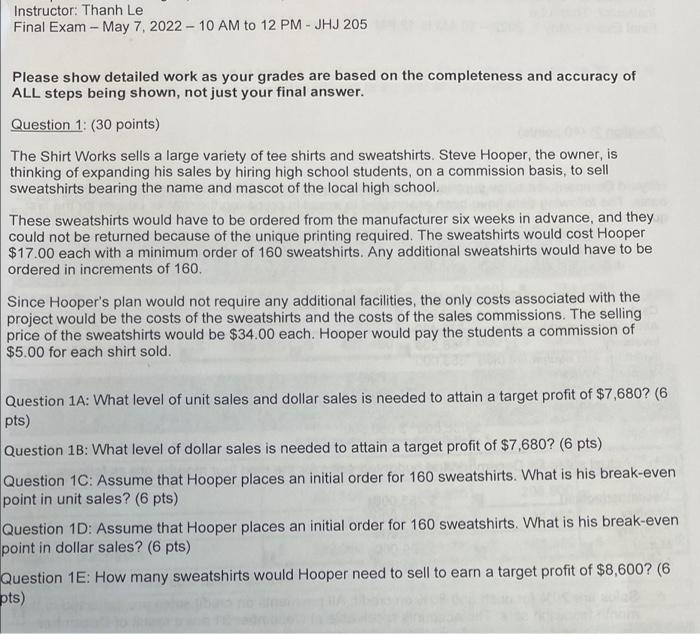

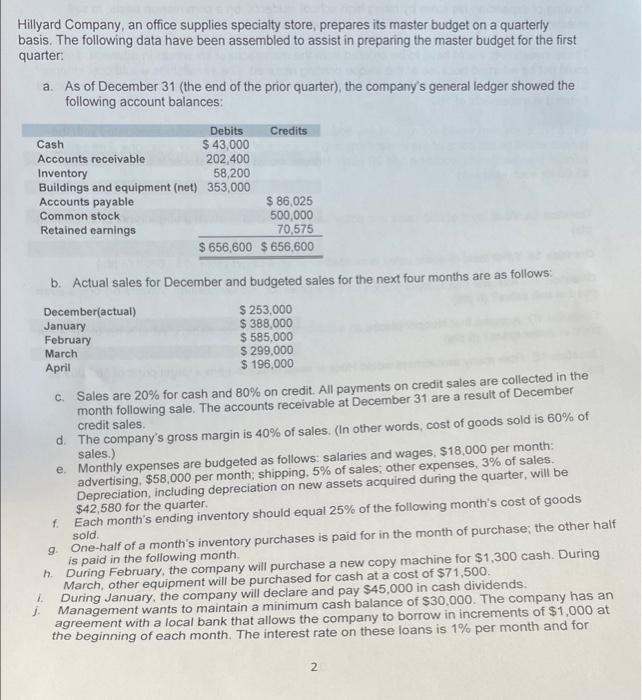

Poes of Accounting (ACCT 232.03) structor Thane Final Exam - May 7.2022 - 10 AM to 12 PMJH205 Please show detailed work as your graces are based on the completeness and accuracy of ALL stops being shown, not just your final answer Question porta) The Shirt Worla sols a large variety of shit and sweatshirt ve Hosper the owner thinking of expanding his sales by Mining high school student on a common boss Shirts bearing them and mascot of the local high school There westshirts would have to be red from the manufacturers wonks in advance and they codd ol be returned because of the unique prired. The sweatshirts would cost ooper 517.00 each with a minimum order of 50 watts. Any additional sweatshirts would have to the ordered in increments or 100 Since Hooper plan would not require any additional facilities the only costs and with the project would be the costs of the tits and the cost of the sales commission. The selling price of the sweatshirts would be $3400 each Hooper would say the students commission of $500 for each shit old Question: What level of unit sales and doar sa smeded to attain target profit of $7.68070 QwistieWhat level of dollar salon is needed to attain a target profit of $7.6807 (6) Question 1 Assume that Hooper places so to order for 160 sweatshirts What is his break even point in unse? (6 pts) Question 10. Assume that Hooper places an innat order for 160 watahimWhat in his break even point in dollar sales (6) Question te How many watuhuts woud Hooper need to set to eam a turpet prott ot 860074 pts) Instructor: Thanh Le Final Exam - May 7, 2022 - 10 AM to 12 PM - JHJ 205 Please show detailed work as your grades are based on the completeness and accuracy of ALL steps being shown, not just your final answer. Question 1: (30 points) The Shirt Works sells a large variety of tee shirts and sweatshirts. Steve Hooper, the owner, is thinking of expanding his sales by hiring high school students, on a commission basis, to sell sweatshirts bearing the name and mascot of the local high school. These sweatshirts would have to be ordered from the manufacturer six weeks in advance, and they could not be returned because of the unique printing required. The sweatshirts would cost Hooper $17.00 each with a minimum order of 160 sweatshirts. Any additional sweatshirts would have to be ordered in increments of 160. Since Hooper's plan would not require any additional facilities, the only costs associated with the project would be the costs of the sweatshirts and the costs of the sales commissions. The selling price of the sweatshirts would be $34.00 each. Hooper would pay the students a commission of $5.00 for each shirt sold. Question 1A: What level of unit sales and dollar sales is needed to attain a target profit of $7,680? (6 pts) Question 1B: What level of dollar sales is needed to attain a target profit of $7,680? (6 pts) Question 1C: Assume that Hooper places an initial order for 160 sweatshirts. What is his break-even point in unit sales? (6 pts) Question 1D: Assume that Hooper places an initial order for 160 sweatshirts. What is his break-even point in dollar sales? (6 pts) Question 1E: How many sweatshirts would Hooper need to sell to earn a target profit of $8,600? (6 pts) Hillyard Company, an office supplies specialty store, prepares its master budget on a quarterly basis. The following data have been assembled to assist in preparing the master budget for the first quarter a. As of December 31 (the end of the prior quarter), the company's general ledger showed the following account balances: Debits Credits Cash $ 43,000 Accounts receivable 202,400 Inventory 58,200 Buildings and equipment (net) 353,000 Accounts payable $ 86,025 Common stock 500,000 Retained earnings 70,575 $ 656,600 $ 656,600 b. Actual sales for December and budgeted sales for the next four months are as follows: December(actual) $ 253,000 January $ 388,000 February $ 585,000 March $ 299,000 April $ 196,000 C. Sales are 20% for cash and 80% on credit. All payments on credit sales are collected in the month following sale. The accounts receivable at December 31 are a result of December credit sales d. The company's gross margin is 40% of sales. (In other words, cost of goods sold is 60% of sales.) e. Monthly expenses are budgeted as follows: salaries and wages. $18,000 per month: advertising, $58,000 per month; shipping, 5% of sales; other expenses, 3% of sales. Depreciation, including depreciation on new assets acquired during the quarter, will be $42,580 for the quarter. 1. Each month's ending inventory should equal 25% of the following month's cost of goods sold 9. One-half of a month's inventory purchases is paid for in the month of purchase; the other half is paid in the following month. n. During February, the company will purchase a new copy machine for $1,300 cash. During March other equipment will be purchased for cash at a cost of $71,500. During January, the company will declare and pay $45,000 in cash dividends. Management wants to maintain a minimum cash balance of $30,000. The company has an agreement with a local bank that allows the company to borrow in increments of $1,000 at the beginning of each month. The interest rate on these loans is 1% per month and for 2 Poes of Accounting (ACCT 232.03) structor Thane Final Exam - May 7.2022 - 10 AM to 12 PMJH205 Please show detailed work as your graces are based on the completeness and accuracy of ALL stops being shown, not just your final answer Question porta) The Shirt Worla sols a large variety of shit and sweatshirt ve Hosper the owner thinking of expanding his sales by Mining high school student on a common boss Shirts bearing them and mascot of the local high school There westshirts would have to be red from the manufacturers wonks in advance and they codd ol be returned because of the unique prired. The sweatshirts would cost ooper 517.00 each with a minimum order of 50 watts. Any additional sweatshirts would have to the ordered in increments or 100 Since Hooper plan would not require any additional facilities the only costs and with the project would be the costs of the tits and the cost of the sales commission. The selling price of the sweatshirts would be $3400 each Hooper would say the students commission of $500 for each shit old Question: What level of unit sales and doar sa smeded to attain target profit of $7.68070 QwistieWhat level of dollar salon is needed to attain a target profit of $7.6807 (6) Question 1 Assume that Hooper places so to order for 160 sweatshirts What is his break even point in unse? (6 pts) Question 10. Assume that Hooper places an innat order for 160 watahimWhat in his break even point in dollar sales (6) Question te How many watuhuts woud Hooper need to set to eam a turpet prott ot 860074 pts) Instructor: Thanh Le Final Exam - May 7, 2022 - 10 AM to 12 PM - JHJ 205 Please show detailed work as your grades are based on the completeness and accuracy of ALL steps being shown, not just your final answer. Question 1: (30 points) The Shirt Works sells a large variety of tee shirts and sweatshirts. Steve Hooper, the owner, is thinking of expanding his sales by hiring high school students, on a commission basis, to sell sweatshirts bearing the name and mascot of the local high school. These sweatshirts would have to be ordered from the manufacturer six weeks in advance, and they could not be returned because of the unique printing required. The sweatshirts would cost Hooper $17.00 each with a minimum order of 160 sweatshirts. Any additional sweatshirts would have to be ordered in increments of 160. Since Hooper's plan would not require any additional facilities, the only costs associated with the project would be the costs of the sweatshirts and the costs of the sales commissions. The selling price of the sweatshirts would be $34.00 each. Hooper would pay the students a commission of $5.00 for each shirt sold. Question 1A: What level of unit sales and dollar sales is needed to attain a target profit of $7,680? (6 pts) Question 1B: What level of dollar sales is needed to attain a target profit of $7,680? (6 pts) Question 1C: Assume that Hooper places an initial order for 160 sweatshirts. What is his break-even point in unit sales? (6 pts) Question 1D: Assume that Hooper places an initial order for 160 sweatshirts. What is his break-even point in dollar sales? (6 pts) Question 1E: How many sweatshirts would Hooper need to sell to earn a target profit of $8,600? (6 pts) Hillyard Company, an office supplies specialty store, prepares its master budget on a quarterly basis. The following data have been assembled to assist in preparing the master budget for the first quarter a. As of December 31 (the end of the prior quarter), the company's general ledger showed the following account balances: Debits Credits Cash $ 43,000 Accounts receivable 202,400 Inventory 58,200 Buildings and equipment (net) 353,000 Accounts payable $ 86,025 Common stock 500,000 Retained earnings 70,575 $ 656,600 $ 656,600 b. Actual sales for December and budgeted sales for the next four months are as follows: December(actual) $ 253,000 January $ 388,000 February $ 585,000 March $ 299,000 April $ 196,000 C. Sales are 20% for cash and 80% on credit. All payments on credit sales are collected in the month following sale. The accounts receivable at December 31 are a result of December credit sales d. The company's gross margin is 40% of sales. (In other words, cost of goods sold is 60% of sales.) e. Monthly expenses are budgeted as follows: salaries and wages. $18,000 per month: advertising, $58,000 per month; shipping, 5% of sales; other expenses, 3% of sales. Depreciation, including depreciation on new assets acquired during the quarter, will be $42,580 for the quarter. 1. Each month's ending inventory should equal 25% of the following month's cost of goods sold 9. One-half of a month's inventory purchases is paid for in the month of purchase; the other half is paid in the following month. n. During February, the company will purchase a new copy machine for $1,300 cash. During March other equipment will be purchased for cash at a cost of $71,500. During January, the company will declare and pay $45,000 in cash dividends. Management wants to maintain a minimum cash balance of $30,000. The company has an agreement with a local bank that allows the company to borrow in increments of $1,000 at the beginning of each month. The interest rate on these loans is 1% per month and for 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts