Question: Please show step by step! Thank you! A and B form the equal AB partnership. A contributes property (FMV=$200,000, basis = $120,000) and B contributes

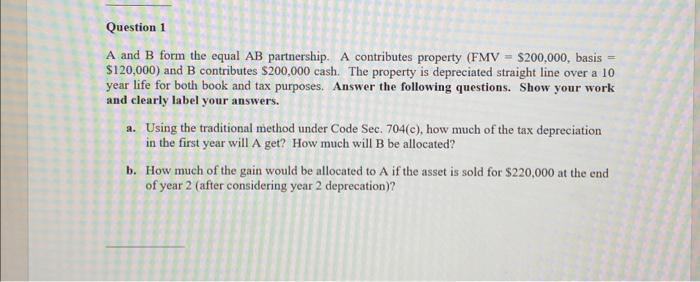

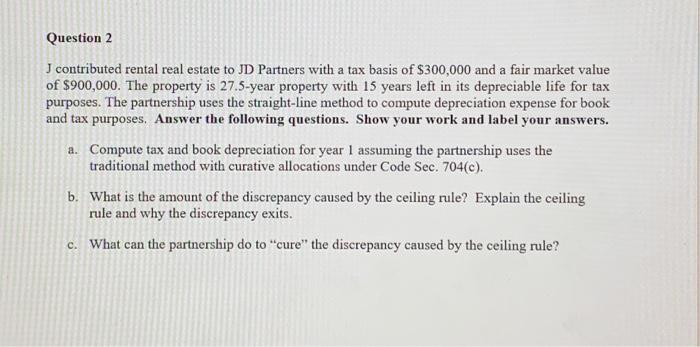

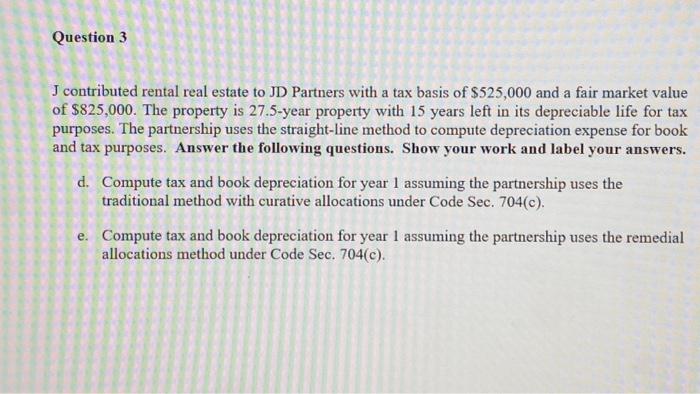

A and B form the equal AB partnership. A contributes property (FMV=$200,000, basis = $120,000) and B contributes $200,000 cash. The property is depreciated straight line over a 10 year life for both book and tax purposes. Answer the following questions. Show your work and clearly label your answers. a. Using the traditional method under Code Sec. 704(c), how much of the tax depreciation in the first year will A get? How much will B be allocated? b. How much of the gain would be allocated to A if the asset is sold for $220,000 at the end of year 2 (after considering year 2 deprecation)? J contributed rental real estate to JD Partners with a tax basis of $300,000 and a fair market value of $900,000. The property is 27.5 -year property with 15 years left in its depreciable life for tax purposes. The partnership uses the straight-line method to compute depreciation expense for book and tax purposes. Answer the following questions. Show your work and label your answers. a. Compute tax and book depreciation for year 1 assuming the partnership uses the traditional method with curative allocations under Code Sec. 704(c). b. What is the amount of the discrepancy caused by the ceiling rule? Explain the ceiling rule and why the discrepancy exits. c. What can the partnership do to "cure" the discrepancy caused by the ceiling rule? J contributed rental real estate to JD Partners with a tax basis of $525,000 and a fair market value of $825,000. The property is 27.5 -year property with 15 years left in its depreciable life for tax purposes. The partnership uses the straight-line method to compute depreciation expense for book and tax purposes. Answer the following questions. Show your work and label your answers. d. Compute tax and book depreciation for year 1 assuming the partnership uses the traditional method with curative allocations under Code Sec. 704(c). e. Compute tax and book depreciation for year 1 assuming the partnership uses the remedial allocations method under Code Sec. 704(c)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts