Question: please show step-by-step work and do keep in mind that it is 2022 when you do the math. thanks! #2. 20 points You are planning

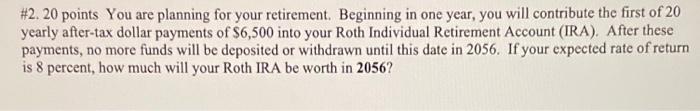

#2. 20 points You are planning for your retirement. Beginning in one year, you will contribute the first of 20 yearly after-tax dollar payments of $6,500 into your Roth Individual Retirement Account (IRA). After these payments, no more funds will be deposited or withdrawn until this date in 2056. If your expected rate of return is 8 percent, how much will your Roth IRA be worth in 2056

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts