Question: please show steps 2. (9 points) Bluebell Co. started operation in January 2021, had pretax accounting income of $9,500,000 and taxable income of $12,500,000 for

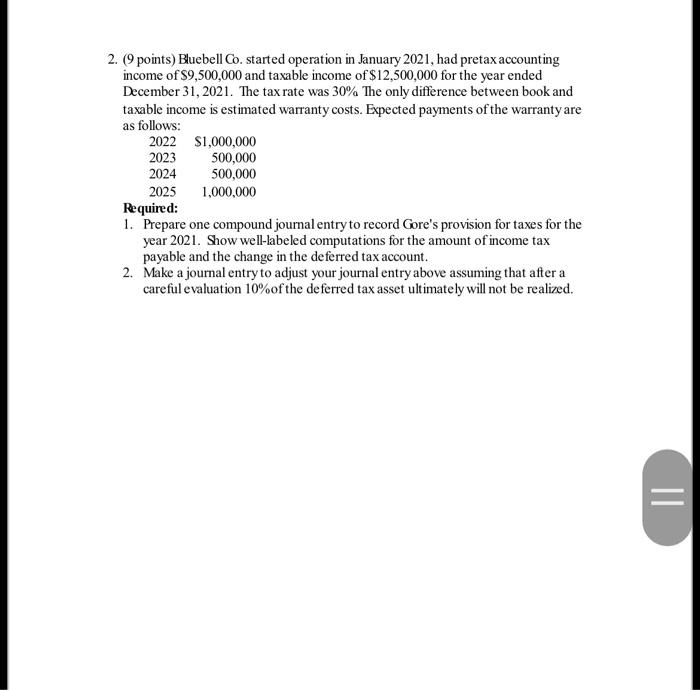

2. (9 points) Bluebell Co. started operation in January 2021, had pretax accounting income of $9,500,000 and taxable income of $12,500,000 for the year ended December 31, 2021. The tax rate was 30% The only difference between book and taxable income is estimated warranty costs. Expected payments of the warranty are as follows: 2022 $1,000,000 2023 500,000 2024 500,000 2025 1,000,000 Required: 1. Prepare one compound journal entry to record Gore's provision for taxes for the year 2021. Show well-labeled computations for the amount of income tax payable and the change in the deferred tax account. 2. Make a journal entry to adjust your journal entry above assuming that after a careful evaluation 10%of the deferred tax asset ultimately will not be realized

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts