Question: Please show steps :) 4) TransWorld Communications, Inc., a large telecommunications company, is evaluating the possible acquisition of Georgia Cable Company (GCC), a regional cable

Please show steps :)

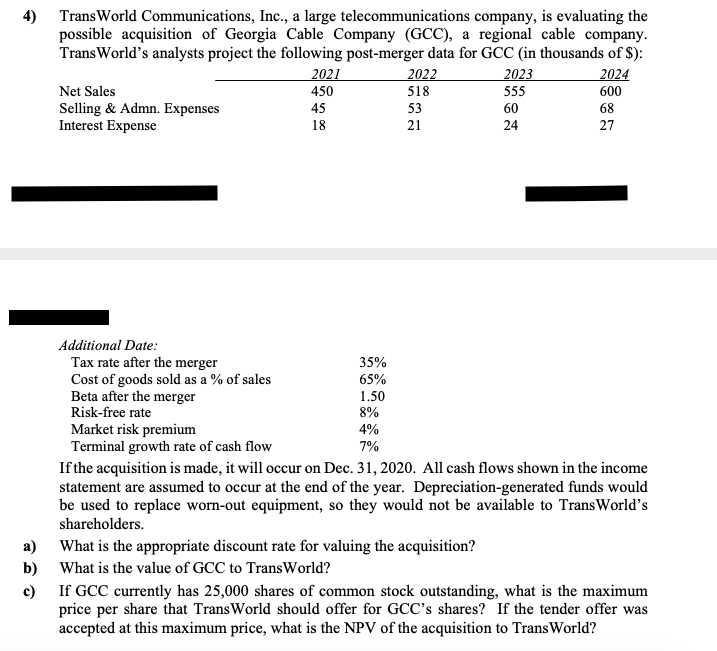

4) TransWorld Communications, Inc., a large telecommunications company, is evaluating the possible acquisition of Georgia Cable Company (GCC), a regional cable company. TransWorld's analysts project the following post-merger data for GCC (in thousands of $): 2021 2022 2023 2024 Net Sales 450 518 555 600 Selling & Admn. Expenses 45 53 60 68 Interest Expense 18 21 24 27 Additional Date: Tax rate after the merger 35% Cost of goods sold as a % of sales 65% Beta after the merger 1.50 Risk-free rate 8% Market risk premium 4% Terminal growth rate of cash flow 7% If the acquisition is made, it will occur on Dec. 31, 2020. All cash flows shown in the income statement are assumed to occur at the end of the year. Depreciation-generated funds would be used to replace worn-out equipment, so they would not be available to TransWorld's shareholders. a) What is the appropriate discount rate for valuing the acquisition? b) What is the value of GCC to TransWorld? c) If GCC currently has 25,000 shares of common stock outstanding, what is the maximum price per share that TransWorld should offer for GCC's shares? If the tender offer was accepted at this maximum price, what is the NPV of the acquisition to TransWorld? 4) TransWorld Communications, Inc., a large telecommunications company, is evaluating the possible acquisition of Georgia Cable Company (GCC), a regional cable company. TransWorld's analysts project the following post-merger data for GCC (in thousands of $): 2021 2022 2023 2024 Net Sales 450 518 555 600 Selling & Admn. Expenses 45 53 60 68 Interest Expense 18 21 24 27 Additional Date: Tax rate after the merger 35% Cost of goods sold as a % of sales 65% Beta after the merger 1.50 Risk-free rate 8% Market risk premium 4% Terminal growth rate of cash flow 7% If the acquisition is made, it will occur on Dec. 31, 2020. All cash flows shown in the income statement are assumed to occur at the end of the year. Depreciation-generated funds would be used to replace worn-out equipment, so they would not be available to TransWorld's shareholders. a) What is the appropriate discount rate for valuing the acquisition? b) What is the value of GCC to TransWorld? c) If GCC currently has 25,000 shares of common stock outstanding, what is the maximum price per share that TransWorld should offer for GCC's shares? If the tender offer was accepted at this maximum price, what is the NPV of the acquisition to TransWorld

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts