Question: please show steps 7. Why does diversification fail to reduce risk when the returns of the two investments purchased are perfectly positively correlated? Under what

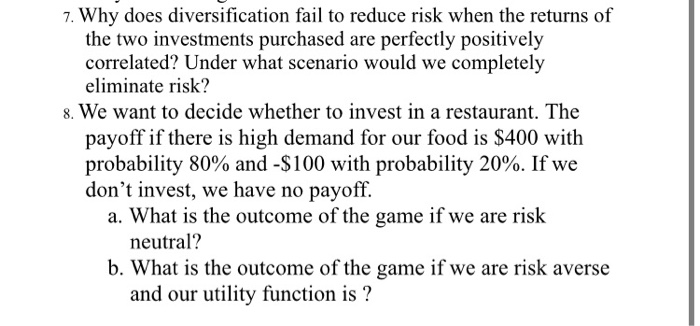

7. Why does diversification fail to reduce risk when the returns of the two investments purchased are perfectly positively correlated? Under what scenario would we completely eliminate risk? 8. We want to decide whether to invest in a restaurant. The payoff if there is high demand for our food is $400 with probability 80% and -$100 with probability 20%. If we don't invest, we have no payoff. a. What is the outcome of the game if we are risk neutral? b. What is the outcome of the game if we are risk averse and our utility function is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts