Question: Please show steps and do not use same answers already posted on Chegg there wrong! Thanks Advanced Accounting Teca corporation Orianized on January 1, 2008,

Please show steps and do not use same answers already posted on Chegg there wrong! Thanks

Please show steps and do not use same answers already posted on Chegg there wrong! Thanks

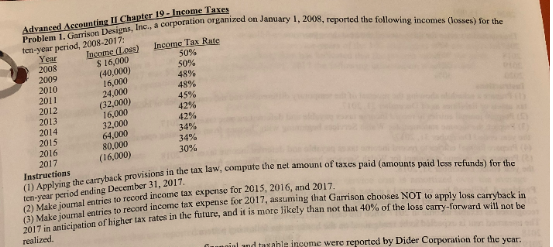

Advanced Accounting Teca corporation Orianized on January 1, 2008, reported the following incomes cesses for the untime IT Chapter 19 Income Taxes Problem 1. Garrison Designs, Inc., a corporation organized fen-year period, 2008-2017 Income (Loss) Income Tax Rate $ 16,000 (40,000) 50% SOX 48% 48% 16,000 24.000 45% 42% 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Instructions 34% (32,000) 16,000 32,000 64,000 80.000 (16,000) 34% 30% sions in the tax law, compute the net amount of taxes paid (amounts paid less rcfunds) for the (1) Applying the carryback provisions in the tax law Ien-year period ending December 31, 2017 2) Make jom tries to record income tax expense Tor 2015, 2016, and 2017 (3) Make journal entries to record income tax expense for 2017 2017 in anticipation of higher tax rates in the future, and it is more likely tha toard income tax expense for 2017, assuming that Gimson choose NOT to apply loss canyback in Chich tax rates in the future, and it is more likely than not that 40% of the loss Curry-forward will not be realized. Gmind taxable income were reported by Dider Corporation for the year Advanced Accounting Teca corporation Orianized on January 1, 2008, reported the following incomes cesses for the untime IT Chapter 19 Income Taxes Problem 1. Garrison Designs, Inc., a corporation organized fen-year period, 2008-2017 Income (Loss) Income Tax Rate $ 16,000 (40,000) 50% SOX 48% 48% 16,000 24.000 45% 42% 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Instructions 34% (32,000) 16,000 32,000 64,000 80.000 (16,000) 34% 30% sions in the tax law, compute the net amount of taxes paid (amounts paid less rcfunds) for the (1) Applying the carryback provisions in the tax law Ien-year period ending December 31, 2017 2) Make jom tries to record income tax expense Tor 2015, 2016, and 2017 (3) Make journal entries to record income tax expense for 2017 2017 in anticipation of higher tax rates in the future, and it is more likely tha toard income tax expense for 2017, assuming that Gimson choose NOT to apply loss canyback in Chich tax rates in the future, and it is more likely than not that 40% of the loss Curry-forward will not be realized. Gmind taxable income were reported by Dider Corporation for the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts