Question: Please show steps and do not use same answers on Chegg thanks! Problem 3. Walsh Services computed pretax financial income of $220,000 for 2017 and

Please show steps and do not use same answers on Chegg thanks!

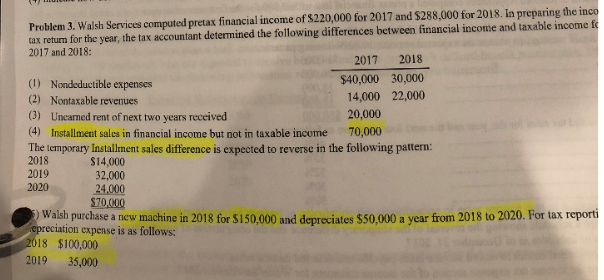

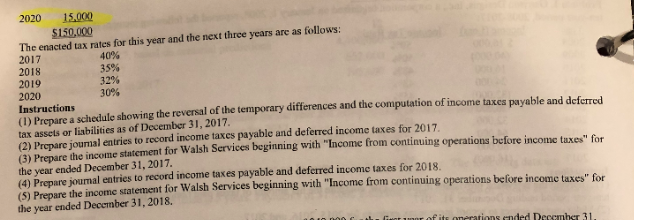

Problem 3. Walsh Services computed pretax financial income of $220,000 for 2017 and $288,000 for 2018. In preparing the inco tax return for the year, the tax accountant determined the following differences between financial income and taxable income fc 2017 and 2018: 2017 2018 (1) Nondeductible expenses $40,000 30,000 (2) Nontaxable revenues 14,000 22,000 (3) Uncanned rent of next two years received 20,000 (4) Installment sales in financial income but not in taxable income 70,000 The temporary Installment sales difference is expected to reverse in the following pattern 2018 $14,000 2019 32,000 2020 24.000 $70,000 5) Walsh purchase a new machine in 2018 for me a new machine in 2018 for SI50.000 and deciates $50.000 a year from 2018 to 2020. For tax reporti preciation expense is as follows: 2018 $100,000 2019 35,000 2020 15.000 $150.000 The enacted tax rates for this year and the next three years are as follows: 2017 40% 2018 35% 2019 32% 2020 30% Instructions (1) Prenare a schedule showing the reversal of the temporary differences and the computation of income taxes payable and defe tax assets or liabilities as of December 31, 2017. (2) Prepare joumal entries to record income taxes payable and deferred income taxes for 2017 (3) Prenare the income statement for Walsh Services beginning with "Income from continuing operations before income taxe for the year ended December 31, 2017. (4) Prepare joumal entries to record income taxes payable and deferred income taxes for 2018 15) Prenare the income statement for Walsh Services beginning with "Income from continuing operations before income taxes" for the year ended December 31, 2018. 10 Or i entuar of its operations ended December 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts