Question: please show steps and or reason for your answer for 9 and 10 9. Which of the following is NOT true about double taxation? a.

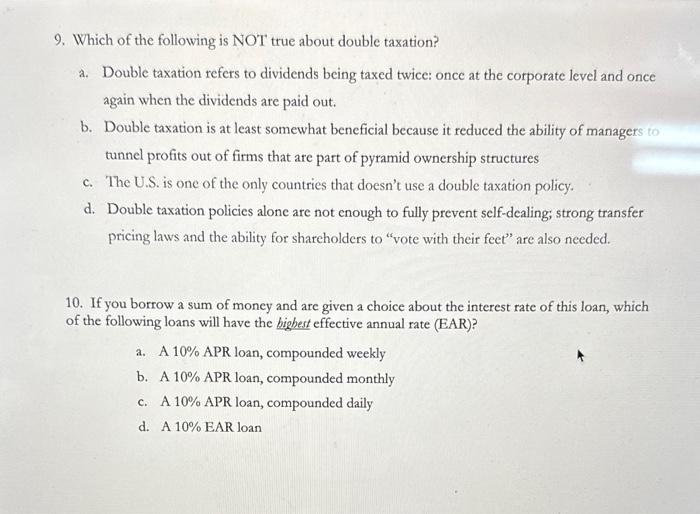

9. Which of the following is NOT true about double taxation? a. Double taxation refers to dividends being taxed twice: once at the corporate level and once again when the dividends are paid out. b. Double taxation is at least somewhat beneficial because it reduced the ability of managers to tunnel profits out of firms that are part of pyramid ownership structures c. The U.S. is one of the only countries that doesn't use a double taxation policy. d. Double taxation policies alone are not enough to fully prevent self-dealing; strong transfer pricing laws and the ability for shareholders to "vote with their feet" are also needed. 10. If you borrow a sum of money and are given a choice about the interest rate of this loan, which of the following loans will have the bighest effective annual rate (EAR)? a. A 10% APR loan, compounded weekly b. A 10\% APR loan, compounded monthly c. A 10% APR loan, compounded daily d. A 10% EAR loan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts