Question: please show steps for all questions 3. A zero coupon bond has a par value of $10,000 and a current price of S6,000. If the

please show steps for all questions

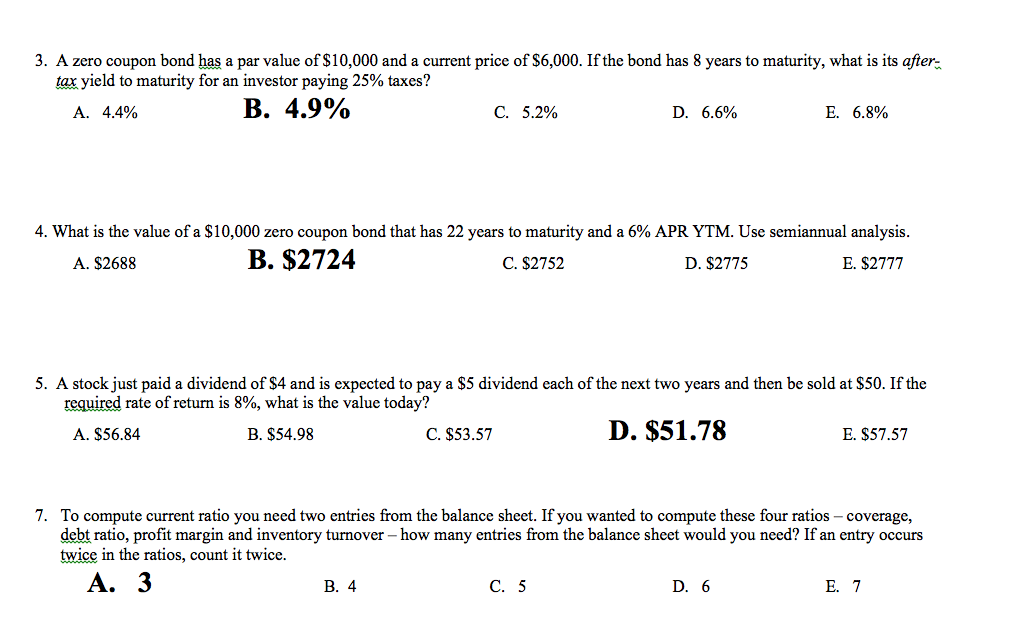

3. A zero coupon bond has a par value of $10,000 and a current price of S6,000. If the bond has 8 years to maturity, what is its after- tax yield to maturity for an investor paying 25% taxes? , 44% B. 4.9% C. 5.2% D. 6.6% E. 6.8% 4, What is the value of a $10,000 zero coupon bond that has 22 years to maturity and a 6% APR YTM. Use semiannual analysis A. $2688 B. $2724 C. $2752 D. $2775 E. $2777 5. A stock just paid a dividend of $4 and is expected to pay a S5 dividend each of the next two years and then be sold at S50. If the required rate of return is 8%, what is the value today? A. $56.84 B. S54.98 C. $53.57 D. $51.78 E. $57.57 7. To compute current ratio you need two entries from the balance sheet. If you wanted to compute these four ratios - coverage, debt ratio, profit margin and inventory turnover - how many entries from the balance sheet would you need? If an entry occurs twice in the ratios, count it twice A. 3 B. 4 C. 5 D. 6 E. 7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts