Question: please show steps for both! Based on the capital asset pricing model (CAPM), which of the following should earn the highest risk premium? A. Diversified

please show steps for both!

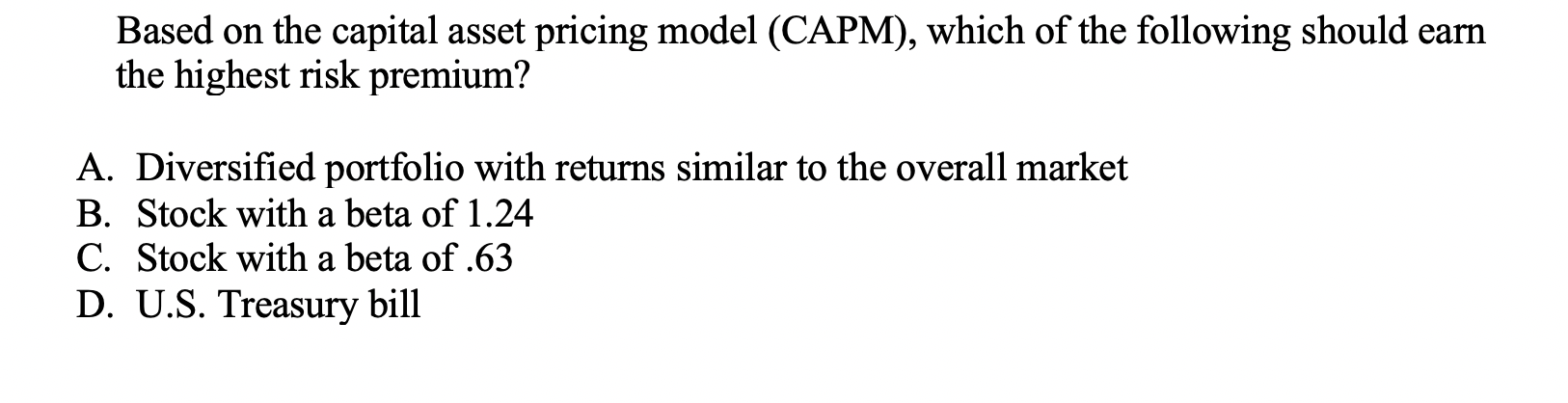

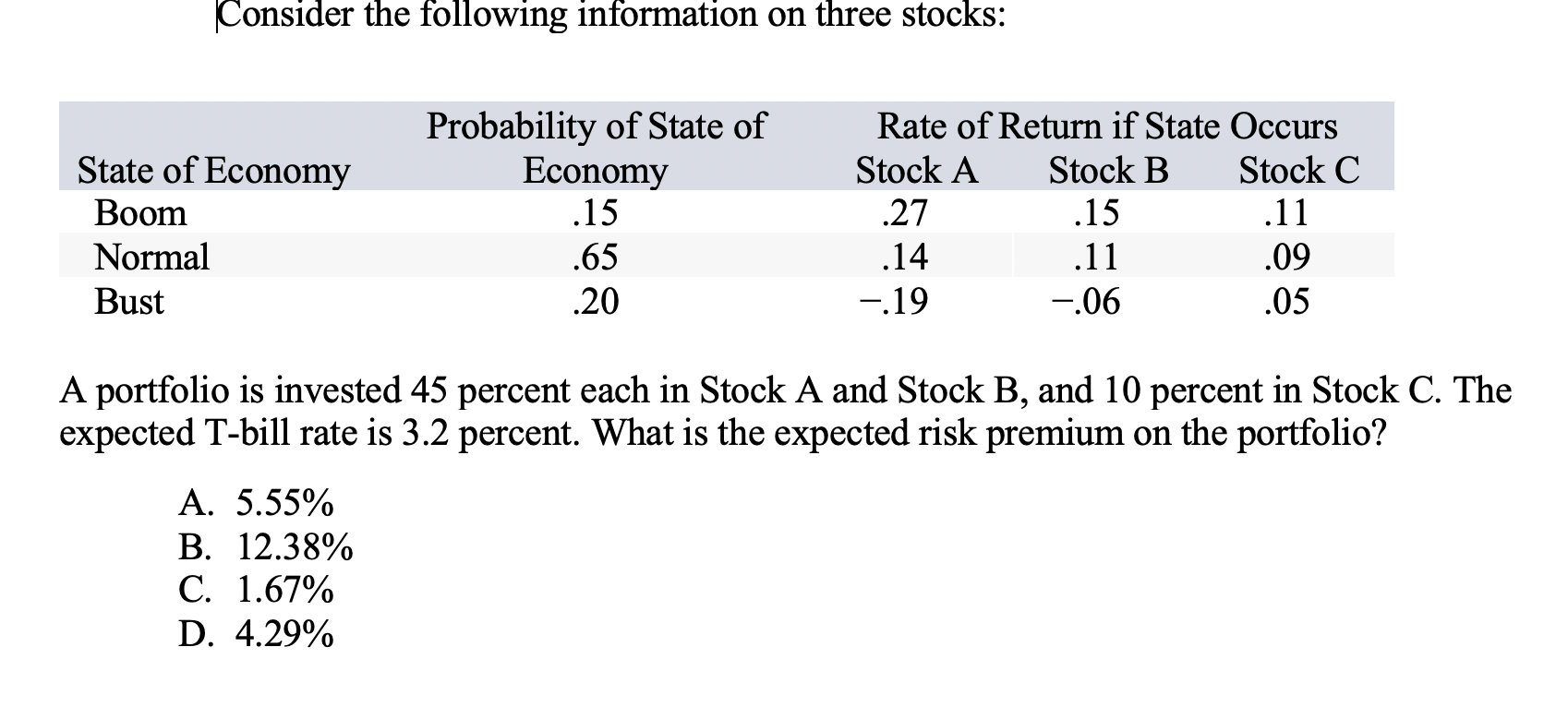

Based on the capital asset pricing model (CAPM), which of the following should earn the highest risk premium? A. Diversified portfolio with returns similar to the overall market B. Stock with a beta of 1.24 C. Stock with a beta of .63 D. U.S. Treasury bill Consider the following information on three stocks: State of Economy Boom Normal Bust Probability of State of Economy .15 .65 .20 Rate of Return if State Occurs Stock A Stock B Stock C .27 .15 .11 .14 .11 .09 -.19 -.06 .05 A portfolio is invested 45 percent each in Stock A and Stock B, and 10 percent in Stock C. The expected T-bill rate is 3.2 percent. What is the expected risk premium on the portfolio? A. 5.55% B. 12.38% C. 1.67% D. 4.29%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts