Question: Please show steps for the three problems and the formulas used. Zoom in if needed. Thanks in advance! if the images can't be clear here

Please show steps for the three problems and the formulas used. Zoom in if needed. Thanks in advance!

if the images can't be clear here they are just in case...

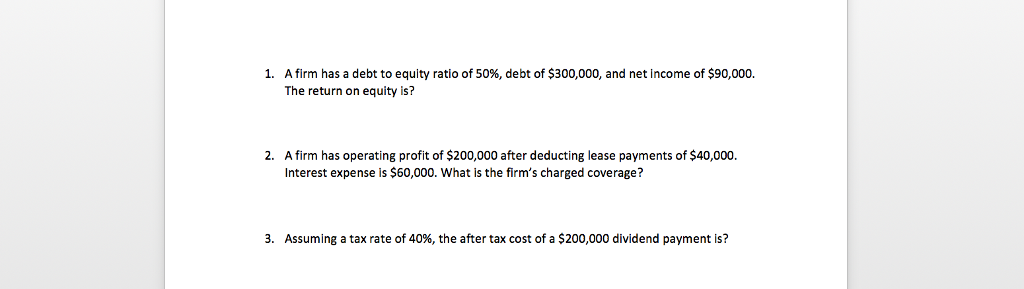

- A firm has a debt to equity ratio of 50%, debt of $300,000, and net income of $90,000. The return on equity is?

- A firm has operating profit of $200,000 after deducting lease payments of $40,000. Interest expense is $60,000. What is the firms charged coverage?

- Assuming a tax rate of 40%, the after tax cost of a $200,000 dividend payment is?

A firm has a debt to equity ratio of 50%, debt of $300,000, and net income of $90,000. The return on equity is? 1. 2. A firm has operating profit of $200,000 after deducting lease payments of $40,000. Interest expense is $60,000. What is the firm's charged coverage? 3. Assuming a tax rate of 40%, the after tax cost of a $200,000 dividend payment is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts